Key Insights:

- Zcash has dropped 40% in a week and 65% from its peak, now trading near a critical technical support level.

- Regulatory crackdowns and developer exits have created negative sentiment, pushing ZEC into a prolonged bearish phase.

- The token has broken below key indicators like the 200-day SMA and MACD, signaling strong downside risk ahead.

Zcash (ZEC) recorded a sharp drop this past week, falling nearly 40% and hitting a three-month low. The privacy-focused token traded at $243 on Thursday, marking its eighth consecutive daily decline. The current price reflects a 65% decrease from its November peak of around $699 and a 53% drop in the last month alone.

The decline followed a broader risk-off phase in the cryptocurrency market. Bitcoin fell towards the $70,000 psychological level, triggering over $1.6 billion in liquidations across major assets. Zcash underperformed during this sell-off, along with other privacy coins like Monero, Dash, and Horizen, which all posted double-digit losses.

Developer Exit Raises Investor Concerns

Investor confidence in Zcash remained fragile after the core development team at Electric Coin Company announced its resignation in early January. Although the company pledged to continue supporting the project, the abrupt leadership change has added uncertainty around the protocol’s roadmap and development continuity.

The Zcash downturn has been further impacted by tightening regulatory measures on privacy tokens. Recent actions include a ban by Dubai’s financial regulator, prohibiting Zcash from being used across all licensed crypto platforms within the Dubai International Financial Centre. These steps follow similar pressures from countries such as Russia and India, where proposals for increased scrutiny and bans on privacy coins have emerged.

Technical Signals Point to Further Decline

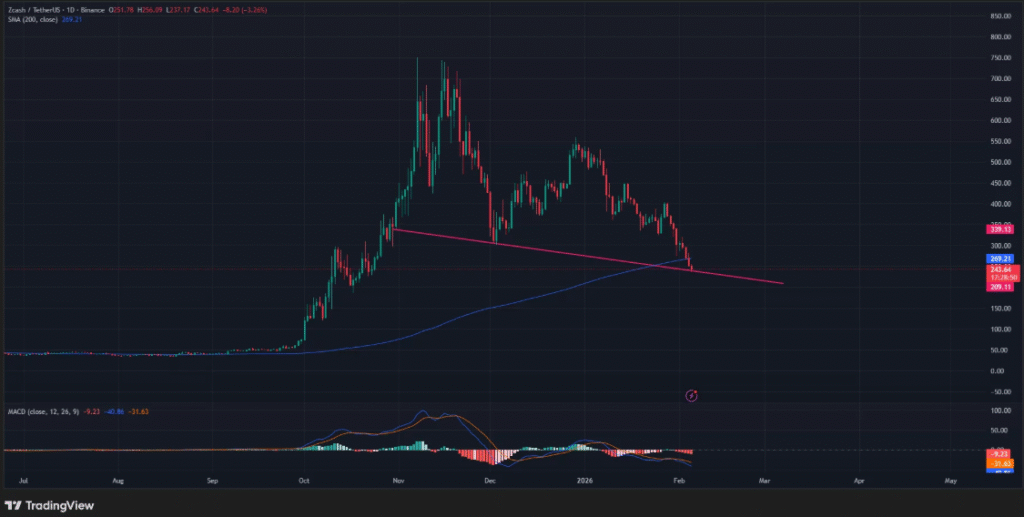

On the technical chart, ZEC is nearing a breakdown from a long-standing descending trendline that had provided critical support in recent months. A fall below this line would indicate bearish control of the market, weakening the position of bulls who had previously defended the support level.

Zcash has also slipped below its 200-day simple moving average, an important long-term trend indicator. Additionally, the MACD shows growing bearish momentum, with the MACD line dropping below the signal line. These indicators confirm increasing pressure on ZEC.

The $200 mark is now the next significant support level for ZEC. A breakdown below this level could trigger further losses as the market seeks a new bottom. Traders are closely watching this zone for signs of stabilization.