Key Insights:

- Zcash enters a markdown phase after a sharp rally, following Wyckoff Theory’s distribution and markdown predictions.

- Zcash may experience a short-term relief rally, but long-term price decline remains possible with strong downtrend signals.

- The token’s recent price drop highlights a significant shift in investor sentiment, marking the end of its markup phase.

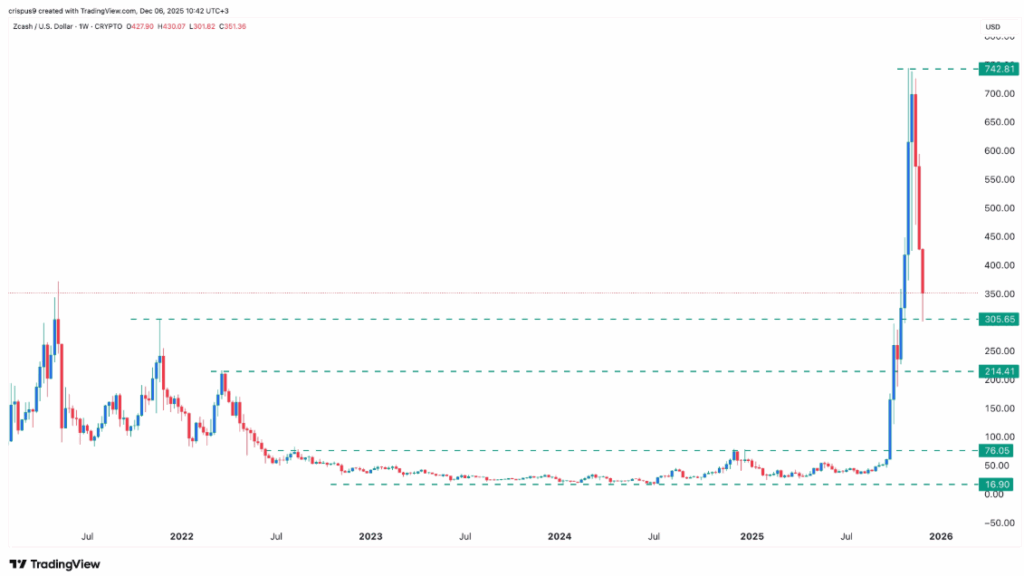

Zcash (ZEC) is currently experiencing a significant price drop, down 12.41% as of December 6, 2025. The privacy token, which traded at $352 today, has fallen by 53% from its highest point this year, reaching its lowest level since December 31. Its market capitalization has plunged from over $11 billion to $5.8 billion. This price action aligns with the predictions made by the Wyckoff Theory, which charts the natural phases of market cycles.

To the average investor, the rapid rise and fall of Zcash’s price may seem like an unpredictable occurrence. However, market technicians are more familiar with these types of moves, especially when they align with established technical theories. The Wyckoff Theory, which dates back over 100 years, breaks down the market’s natural progression through accumulation, markup, distribution, and markdown phases. According to this theory, Zcash’s recent price movement follows a textbook example of these phases.

Accumulation Phase Leads to a Price Surge

Zcash’s price stagnated for over three years, remaining in a tight consolidation range due to various factors. Regulatory concerns and delisting from many exchanges prevented the token from participating in market rallies. However, in September 2025, Zcash entered the markup phase, prompted by the news that Grayscale had filed for a Zcash fund. This triggered a surge, pushing the token into new highs.

Zcash has now entered the distribution and markdown phases, according to Wyckoff’s theory. The token formed a double-top pattern at $740, which led to widespread panic selling. This market behavior is typical in the distribution phase, where the initial surge is followed by heavy selling. The three black crows pattern, characterized by three consecutive bearish candles, indicates that the token is in a strong downtrend.

Potential for a Short-Term Relief Rally

Despite the ongoing downtrend, there are signs that Zcash may experience a short-term relief rally. The token recently retested its key support level at $305, a price point it reached in November 2021. If this support holds, a brief rebound could occur, particularly as investors await news on the approval of the Grayscale ZEC ETF by the SEC. However, this rally is expected to be short-lived, commonly referred to as a dead-cat bounce, before the downtrend resumes.

If Zcash fails to maintain its support level at $305, it could face further downside risks. The next significant support level lies at $215, the token’s peak price in March 2022. Should this level fail to hold, additional declines in price could follow, putting Zcash in a prolonged downtrend.