Key Insights:

- XRP price has fallen 57% from its all-time high, driven by weak DeFi activity on the XRP Ledger.

- The XRP burn rate has stagnated since last year, showing minimal effect on price movement.

- XRP’s stablecoin and RWA tokenization sectors are showing growth, with a 271% increase in tokenized assets.

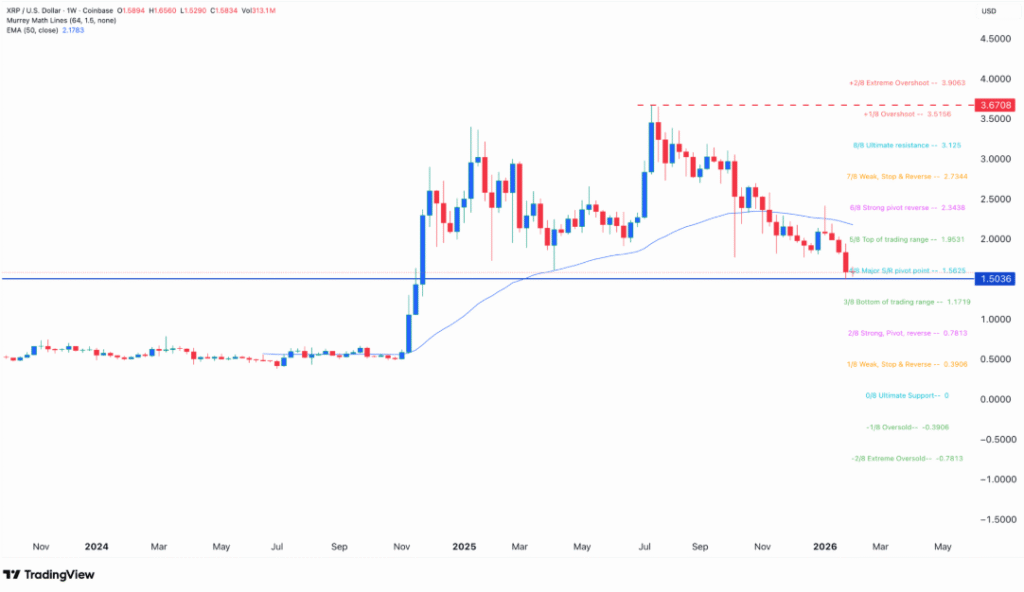

XRP’s price has plunged sharply, marking its lowest level since November 2024. The cryptocurrency is facing a 57% drop from its all-time high, primarily driven by weakening DeFi metrics on the XRP Ledger and a declining burn rate. This negative trend could continue as the blockchain’s decentralized finance ecosystem shows minimal growth.

XRP’s performance in the decentralized finance (DeFi) industry continues to lag behind major players like Ethereum and Solana. Data from DeFi Llama shows that XRP Ledger hosts only 21 protocols, with a total value locked (TVL) of just $55 million. Over the past month, the TVL has dropped by over 20%. The platform also saw only $145,820 in decentralized exchange (DEX) volume over the last 24 hours. In stark contrast, Ethereum has $60 billion in TVL and handled $3.1 million in DEX volume during the same period.

Stablecoin and RWA Tokenization Show Positive Signs

Despite the downturn in DeFi, XRP has found success in the stablecoin and real-world asset (RWA) tokenization sectors. XRP’s stablecoin supply surged to $417 million, with Ripple USD (RLUSD) becoming one of the top stablecoins. Furthermore, the value of real-world assets tokenized on the XRP Ledger reached over $1.47 billion, marking a 271% increase in the last month. Major players, including Vert Capital and Guggenheim, are also contributing to this growth.

The XRP burn rate has decreased substantially in recent months, with only 335 XRP tokens burned on February 3. Since August of the previous year, the burn rate has stagnated, showing little impact on price movement. This reduction in burn activity is contributing to the ongoing bearish sentiment around XRP.

Ripple Expands Globally Despite Market Struggles

In positive news, Ripple Labs continues to expand its regulatory reach, having recently secured a Luxembourg license. This follows the company’s previous licenses in the UK and several other nations, including a banking charter in the United States and a money license in the EU. These regulatory achievements may help stabilize the company’s long-term outlook.

The technical analysis of XRP’s price chart shows a continued downtrend, with the coin having fallen for five consecutive weeks. Currently, XRP is hovering near a critical support level, with the risk of breaking below the $1 psychological price level. If the price drops further, it could hit the $0.7813 level, marking a more significant downturn for XRP.