Key Insights

- XRP has lost 40% in one month, dropping below key support levels and trading near its lowest price since November 2024.

- Trading volume spiked 30% to $5.04 billion, highlighting panic selling, while open interest hit a multi-month low.

- The crypto market dropped over 6.5% in value amid macroeconomic uncertainty, with extreme fear driving investor sentiment.

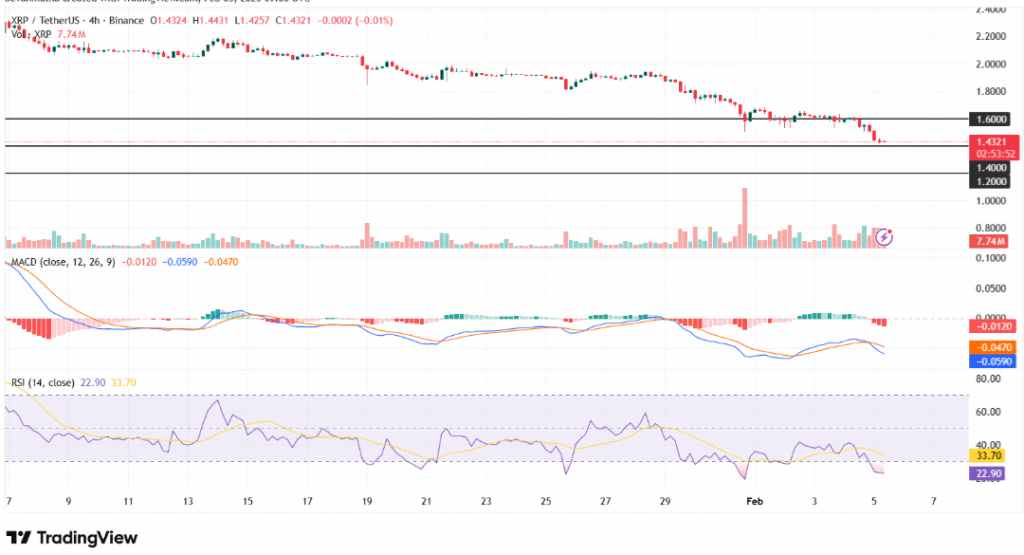

XRP price continued its downward spiral on Thursday, trading around $1.43 after a sharp 10% daily loss. This decline dragged the cryptocurrency to its lowest point since November 2024. Over the past week, XRP has dropped by 20%, with losses expanding to nearly 40% for the month.

The price fell below the significant $1.60 support zone, signaling a deepening bearish trend. If this momentum persists, XRP could fall further to $1.40 and even approach $1.20 in the coming sessions. Resistance has formed at $1.60, where selling pressure has consistently pushed back gains.

Market-Wide Liquidations Add to Pressure

The broader crypto market recorded approximately $770 million in liquidations within 24 hours, with most from long positions. Panic among bullish traders intensified the sell-off. XRP’s trading volume surged by 30% to $5.04 billion, reflecting increased sell-side activity.

The Crypto Fear and Greed Index dropped to 11, highlighting a climate of extreme fear among investors. The total cryptocurrency market capitalization declined by 6.57%, falling to $2.42 trillion. Risk-averse behavior was triggered by rising macroeconomic concerns.

Macro Events Amplify Downturn

Traditional markets added to the pressure as the Federal Reserve held interest rates at 3.50–3.75% on January 28. Shortly after, President Donald Trump nominated Kevin Warsh to replace Jerome Powell as Fed Chair. This development unsettled markets and fueled uncertainty.

XRP derivatives trading reflected further weakness. Open interest reached its lowest point since November 2024, reducing speculative demand. While Bitcoin ETFs recorded declining interest, XRP spot ETFs saw a modest net inflow of $4.83 million, providing slight relief.

Technical Indicators Suggest Further Downside

Technical indicators pointed to sustained selling. The MACD remained in negative territory with a bearish crossover, while the RSI dropped to 22, indicating deeply oversold conditions. Although this could suggest a potential short-term bounce, bearish pressure remains dominant.

Leading cryptocurrencies also posted heavy losses. Bitcoin slid toward $70,000, and Ethereum fell to $2,000. Other tokens such as Solana, Dogecoin, and Cardano, followed with double-digit declines. Market confidence remained low as investors reacted to economic and political developments.