Key Insights:

- XRP moves back above $2, reclaiming the middle Bollinger Band and signaling a shift in short-term market control.

- The upper Bollinger Band at $2.52 marks the next resistance, with potential for a broader rally if broken.

- Holding above $1.74 on the monthly chart keeps XRP on a bullish path toward the upper band near $3.61.

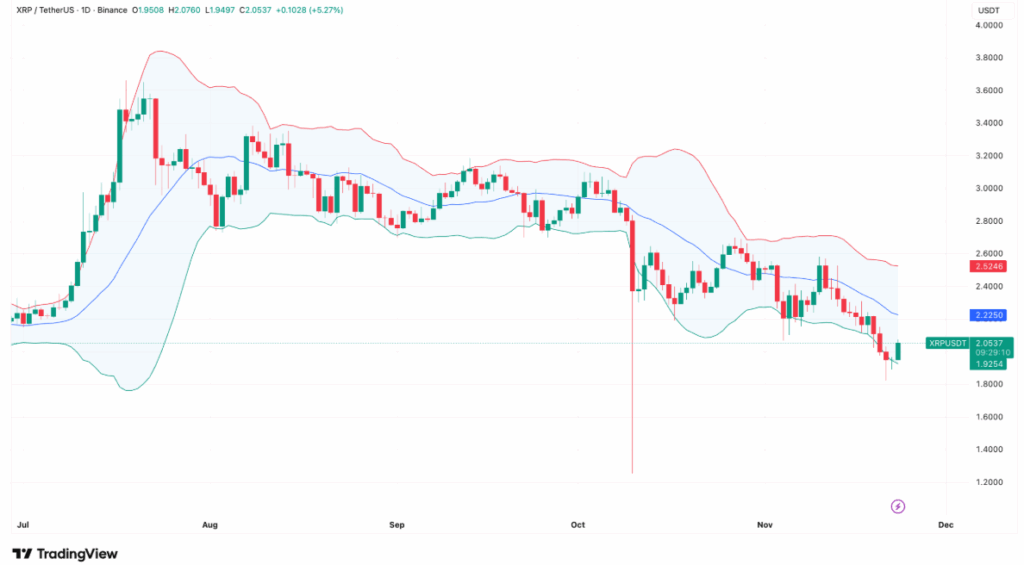

XRP has moved back above the $2 mark after several days of trading under pressure. On the daily chart, the token now trades near $2.04, regaining a key technical level and signaling renewed buyer interest. The move comes after XRP hovered near the lower Bollinger Band at $1.92, a zone often associated with downward pressure.

The recent uptick puts XRP above the middle Bollinger Band at $2.02. This development reflects a shift in momentum, as holding above the mid-band often suggests sellers are losing strength. With price action climbing back into the upper half of the band’s range, the setup favors continued gains if current support levels hold.

Next Resistance at Upper Band

The immediate technical target is the upper Bollinger Band on the daily chart, located near $2.52. XRP has tested this level in the past but failed to break through. A push beyond this threshold may lead to stronger momentum and improved market sentiment. The structure of the bands also indicates increased volatility, which often precedes significant price swings.

On the weekly chart, XRP is trading just below the mid-band level at $2.22. Notably, the price did not fall below the lower band around $1.80 during the recent correction, preserving the overall bullish structure. This range has held steady for several months and remains intact.

The monthly chart adds to the optimistic picture. XRP continues to hold above the key monthly mid-band level of $1.74. Remaining above this level suggests that the long-term trend remains stable. Technical conditions support an eventual move toward the upper monthly band, currently located around $3.61.

If XRP continues to maintain its position above the critical mid-band levels across daily, weekly, and monthly charts, the technical path toward higher levels remains intact. The setup favors an extended upside scenario, backed by consistent support and increasing volatility.