- Falling wedge breakout on chart sets sights on $0.54 — a 40% jump from $0.38

- Inverse head-and-shoulders suggests long-term target near $0.95

- Over 400K new wallets, $600M in RWAs boost Stellar’s network strength

Stellar (XLM) just broke out of a key wedge pattern, igniting serious bullish momentum. With explosive on-chain growth and strong technicals, XLM could be gearing up for a massive rally toward the $0.95 mark.

XLM Breaks Out of Falling Wedge, Targets $0.54

Stellar (XLM) is turning bullish after breaking out of a falling wedge pattern on the 8-hour XLM chart. This formation usually shows up before an upward price move.

Posted by clifton_ideas on X, the breakout happened around $0.38. Since then, XLM has shown strong green candles and rising volume. This signals growing buyer interest.

The wedge’s height points to a target near $0.54, marking a possible 40.45% rally from the breakout zone. The token’s price is now $0.3893, up 3.70% in 24 hours and 7.92% over the past week.

If XLM holds above the breakout level, the uptrend may continue. But if it slips, support could be found near $0.34, close to the lower wedge line.

Bigger Pattern Points to $0.95 Target

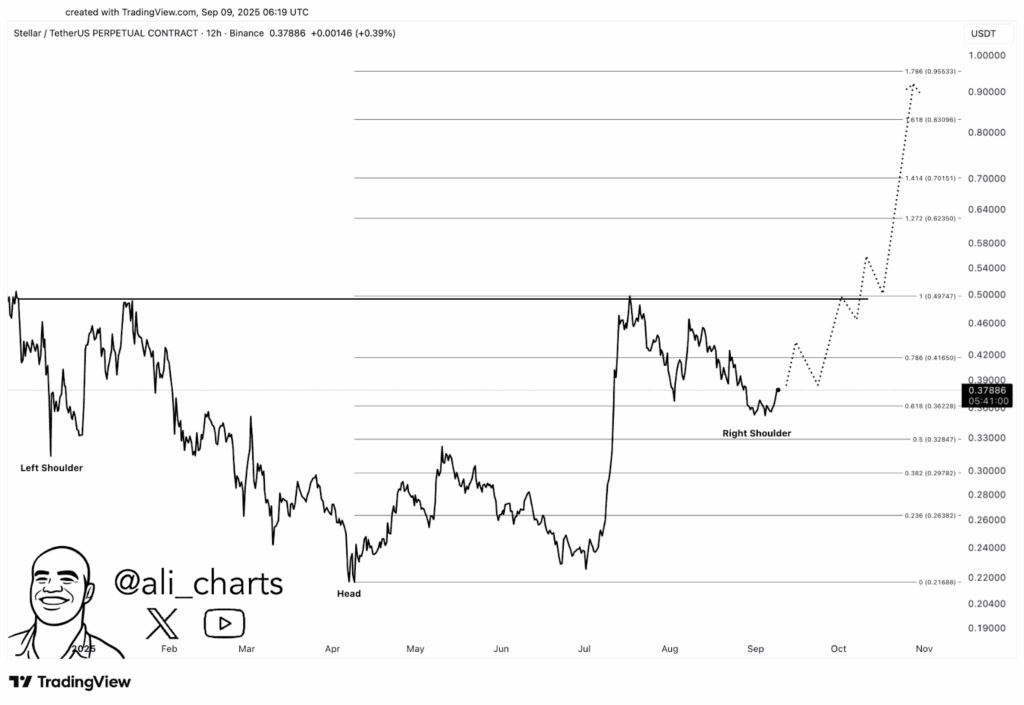

Another analyst Ali Martinez on X observed that a pattern is forming with an inverse head-and-shoulders. It’s a classic signal of a market reversal from bearish to bullish.

Source Ali Martinez

The neckline is near $0.50. If XLM breaks this level with strong volume, it could open the door for a rally toward $0.70, $0.83, and even $0.95.

These levels line up with Fibonacci extensions. They help traders map out where price might hit resistance. The long-term setup points to a 150% upside from current prices.

If XLM clears the neckline and retests it as support, the breakout could attract more buyers and build momentum.

User Growth and Real-World Demand Fuel Optimism

Fundamentals back the technical story. In a CoinDesk interview, Stellar CEO Denelle Dixon said the network added 400,000 new addresses last quarter. Wallets like Decaf and Vibrant are driving this surge.

Stellar also hit over $600 million in tokenized real-world assets (RWAs) in the first half of the year. DeFiLlama reports Stellar’s TVL at $143.35 million. The goal is to hit $1 billion — a 597% jump.

Dixon said that both permissioned and permissionless assets will drive future growth. She also pointed to rising interest in cross-border stablecoin settlements. MoneyGram already uses Stellar for fast payments.

Since launching in 2014, Stellar has grown into a key payment layer for global finance. With new features and growing use, XLM is showing signs it’s ready for a strong breakout