- TAO trades near $329 as buyers defend lower levels while volume expands across the session.

- A wedge structure remains active with traders watching a possible breakout signal this week.

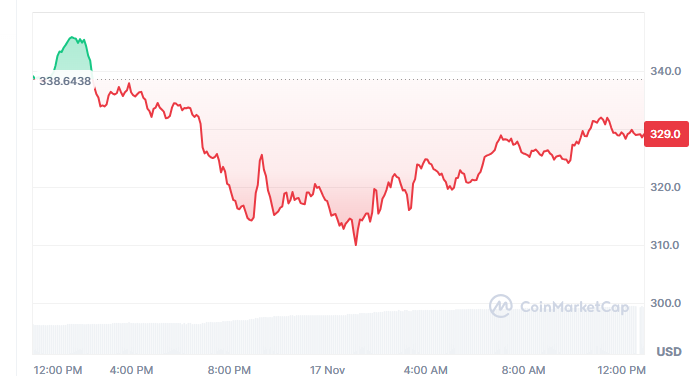

- Intraday action shows a recovery from the $310 zone after a sharp early-session drawdown.

TAO shows early signs of stabilization after a volatile trading session, with the market assessing whether the current structural compression may lead to a short-term recovery as buyers defend a key support zone.

TAO begins the session with pressure but forms signs of stability as buyers react to lower levels

TAO opened the past session with a controlled but steady decline as sellers pressed the market from the $338 zone into a deeper drawdown phase. Price action later stabilized as buying interest emerged near the lower boundary. This shift allowed the market to consolidate around mid-range levels with more balanced flows.

TAO traded near $329 at the end of the 24-hour window. The move represented a mild retreat but also showed that buyers stepped in after the early-session rejection. The market then entered a short consolidation phase as traders assessed the broader structure. This provided the first hint of stabilization after notable volatility.

Captain Faibik shared that the falling-wedge pattern on the 2-hour chart remains intact and may support a recovery structure. The view focuses on the wedge’s lower trendline, which continued to attract buyers during repeated tests.

Buyers react after a sharp intraday drop as volume increases across the market

TAO recorded a strong move downward into the $310–315 zone, creating the session’s deepest price point. A firm reaction developed in this area, which aligned with a spike in trading volume. The volume rose more than 60% to reach roughly $214 million during the period.

The combination of a deeper pullback and increased liquidity suggested that both sides were active around the session’s low. Buyers absorbed the sell pressure, which allowed TAO to rebound into mid-range pricing. This reflected a shift from heavy selling to short-term balance.

The recovery carried TAO back toward the $320 level and then into a steady movement around $329. While not a full reversal, the response prevented a continuation of the early decline and redirected attention to current resistance zones.

Market structure remains intact as traders watch the wedge pattern for a breakout signal

The falling-wedge formation on the 2-hour chart still guides short-term sentiment. The lower boundary has held despite multiple tests, supporting the idea of market compression ahead of a potential move. A break above the upper trendline may open a path toward the projected 30% rally mentioned in the shared post.

TAO’s supply structure remains tight, with 10.32 million tokens circulating out of $21 million total. The market cap stands near $3.39 billion, providing a stable framework for short-term volatility. These conditions help maintain interest from traders watching the wedge structure.

The intraday rebound from the $310 zone establishes a temporary support base. Traders now look toward the $335–340 area as the next key resistance window needed for further progress.