- TAO reclaims major trendlines, forming a bullish compression structure before testing key resistance near $450.

- Rising volume and steady accumulation support a potential breakout toward the $550 zone.

- Price stability near $440 signals firm buyer control amid tightening market compression and solid capitalization.

TAO displays structural strength as price consolidation tightens above key support levels, suggesting a developing bullish setup supported by strong liquidity and accumulation.

Market Structure Reclaim and Technical Shift

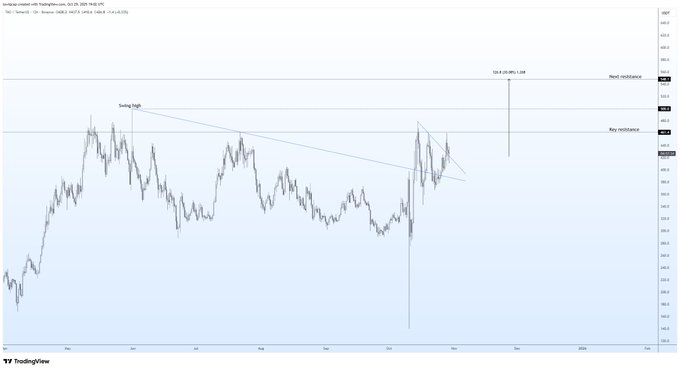

The chart shared by analyst Livercoin (@Livercoin) illustrates a decisive technical turnaround for TAO/USDT, where the token has reclaimed both macro and micro diagonals after months of consolidation. This move represents a structural shift in momentum as buyers regain control over the broader trend. The formation of higher lows and narrowing price action signals compression before expansion — a condition often preceding large directional moves.

According to the analysis, TAO’s breakout from the descending diagonal trendline has reset its technical foundation. The token is now approaching two major resistance levels, the first between $420 and $440, followed by the macro swing-high target near $550. Sustained price acceptance above the initial resistance could confirm the start of an expansion phase, potentially leading to the upper zone where liquidity clusters remain.

Compression beneath resistance is a recurring bullish signal in higher-timeframe structures. In TAO’s case, this pattern indicates buyers are accumulating within a controlled range, reducing volatility while preparing for directional continuation. Volume consistency across sessions reinforces the argument that market participants are positioning early for a possible breakout.

Market Activity and Volume Correlation

Market data as of writing, shows TAO trading at $442.88, rising 2.2% within 24 hours, in the $418.04–$453.29 range. This consistent gain is in line with the consolidation stage described in the chart, as temporary stability following prior volatility. While intraday volatility, trading volume has been extremely high at $448.85 million in 24 hours — an amount showing good liquidity and busy trading.

TAO has a market cap of $4.25 billion supported by an FDV of $9.3 billion indicating the path of growth. Continuous turnover at levels of resistance confirms that buyers are holding up every dip, supporting the market and absorbing short-term supply pressure.

The bounce around $427.52, accompanied by a surge in volume over $404 million, indicates bullish intraday demand. Such consistent rejections from lower levels tend to herald broader directional moves when supported by technical compression, affirming the market’s preparation for expansion.

Short-Term Outlook and Key Resistance Levels

Structurally, TAO’s compression phase remains intact. The 24-hour consolidation near resistance mirrors a tightening market where volatility contracts before momentum resumption. The relatively low circulating supply of 9.59 million TAO out of 21 million total ensures controlled inflation, favoring longer-term accumulation behavior.

The next key test lies around $450, where a breakout could extend momentum toward $470–$480, followed by a potential run to $550 as projected in the technical setup. Conversely, if TAO fails to sustain this level, a retest toward $400–$420 could occur before the next leg higher.

TAO’s alignment across multiple timeframes — with diagonal reclaims, reduced volatility, and strong liquidity support — paints a scenario of growing structural strength. If broader sentiment remains supportive, the asset appears well-positioned for a continuation phase toward the projected resistance levels.