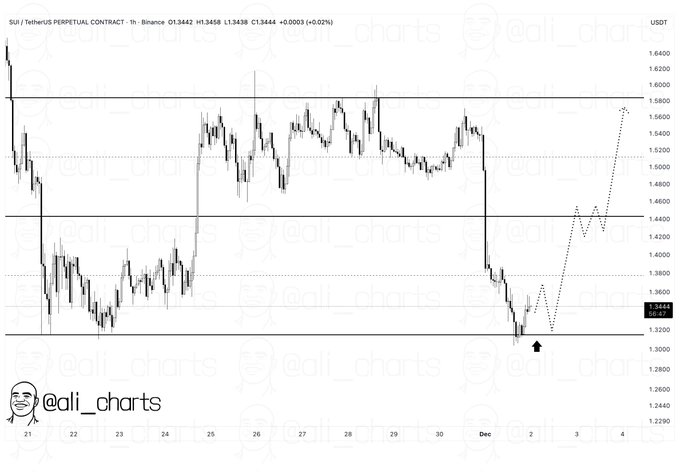

- Sui tests a demand zone after a sharp move, with market structure showing signs of a potential shift.

- A liquidity sweep under $1.32–$1.34 suggests a deviation as buyers respond at a key support area.

- Reclaiming $1.40–$1.42 may clear the path toward $1.50 and the upper boundary near $1.60.

Sui enters the new week near a crucial structural point as market action approaches a demand zone that has repeatedly triggered upward movements. Current trading behavior hints at a decisive moment for the asset’s short-term direction.

Market Structure Near a Critical Zone

The price as of writing is at $1.34 after a volatile session that created a sharp intraday decline. The market moved from the $1.37 area before slipping toward the lower boundary of the recent range. This shift brought price back into a zone where buyers had shown strength earlier in the month.

A liquidity sweep formed below the $1.32–$1.34 band, which acted as an accumulation shelf during previous reactions. The move created a wick that resembled a stop-hunt pattern often seen before a new attempt at expansion. The response candle shows buyers stepping in at a familiar defense level.

Analyst Ali (@ali_charts) noted that if this zone holds, Sui may revisit the $1.60 region. The emerging higher-low formation supports the observation that this could be a deviation instead of a true breakdown. Acceptance above $1.33 remains central to that view.

Mid-Range Level as the Immediate Test

The next checkpoint for Sui sits near $1.40–$1.42, where the mid-range formed a block of resistance. This area served as a turning point in earlier moves and now stands as the first objective before any further recovery attempt. A clean return to this level may reveal the next directional cue.

Maintaining strength above the current band could allow price to approach this zone with momentum. Market behavior inside this layer has previously set the stage for broader range movement. A return to the midpoint would confirm that recent selling formed only a deviation.

If the mid-range breaks, the previously active $1.50 level becomes visible again. That zone acted as a distribution barrier where upward attempts stalled. The efficiency of the earlier downside move creates room for an equally fast rebalancing if buyers maintain pressure.

Liquidity Clusters Point Toward Upper Targets

The $1.60 boundary remains the upper magnet within this structure. Liquidity from trapped breakout traders and late buyers sits above that level. Markets often revisit those clusters when demand strengthens at the base of a range.

Reaching the upper band requires a solid hold above the mid-range and continued defense of the current demand zone. The chart structure aligns with the observation that a move back to that range high becomes more viable if support remains intact. Liquidity mechanics add weight to this progression.

Sui’s broader fundamentals remain stable, with a $5.03B market cap and active trading volume above $600M. Despite the recent decline, market activity shows consistent engagement. The Coinbase expansion for New York residents adds new access while price continues to consolidate near a structural pivot.