- Stellar’s ‘Whisk’ upgrade introduces parallel transaction processing, boosting throughput and reducing latency.

- The total value locked (TVL) in Stellar’s ecosystem surged to $140 million, reflecting strong growth.

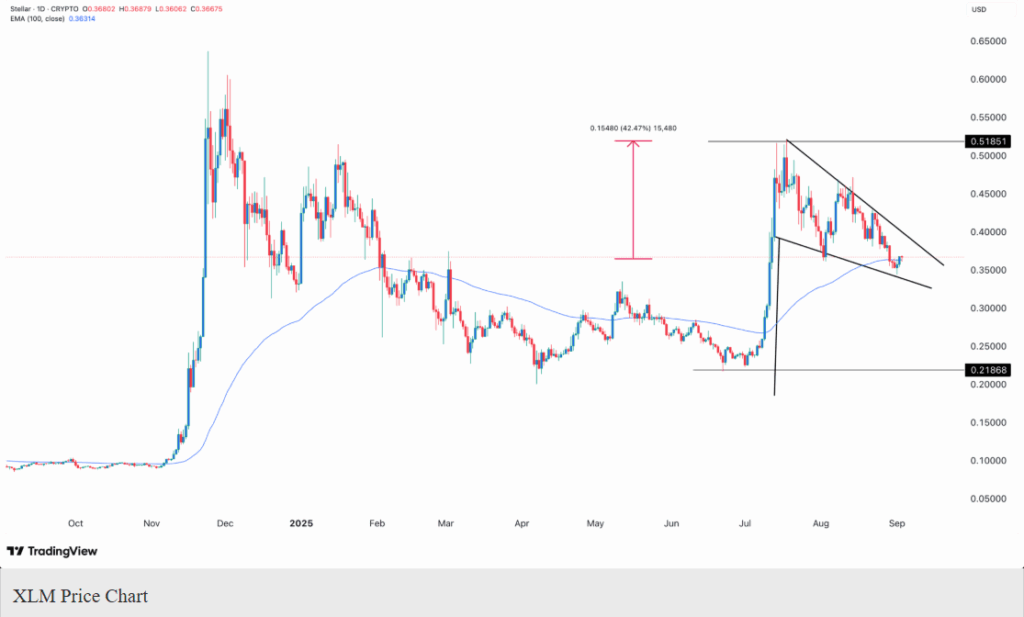

- XLM finds substantial support at its 100-day Exponential Moving Average (EMA), signaling potential bullish movement.

Stellar Lumens (XLM) has been experiencing upward momentum, with its price climbing to $0.3672 as of September 3, following the implementation of the highly anticipated Whisk upgrade. This increase in price comes after XLM dropped to a weekly low of $0.3456 earlier this week. The latest upgrade, which introduces several advanced features, could signal a potential surge in the coming weeks.

The Whisk upgrade brings dozens of new functions that are aimed at enhancing the work of the Stellar network. One of the important upgrades is parallel transaction processing (PTP), which is a novel technology that enhances the throughput of the network and minimizes latency. Stellar wants to be one of the fastest blockchain platforms in the industry by supporting transactions, particularly as the volume of transactions increases. These enhancements will likely increase the number of developers and users on the network, further strengthening its long-term growth.

Stellar Ecosystem has good growth.

Stellar has experienced tremendous growth in recent months, as its total value locked (TVL) is currently 140 million, as per DeFi Llama. This makes Stellar one of the fastest-developing blockchain networks, which highlights the effectiveness of its technological improvements. Also, the stablecoin supply in the network grows steadily, reaching $710 million, with a significant portion of it being owned by the Franklin Templeton tokenized asset. Such developments indicate increasing confidence about the Stellar ecosystem.

The technical outlook of XLM has bullish potential.

Technically, the XLM is in a potential surge. The cryptocurrency has managed to get a stronghold at its 100-day Exponential Moving Average (EMA), which is one of the indicators that denote a positive mood. XLM has also developed a falling wedge structure, which is usually an indication of an upward turn in a downtrend. This trend is emerging following a robust price upsurge over the first half of the year as XLM shot up from a low of $0.2186 to a high of $0.5185.

Provided that XLM does not reach below the support level of $0.30, it might be ready to reach its year-to-date peak of $0.5185. Any such decline below this support would, however, cast doubt on the bullish view and even stop the current movement.