- SPX6900 maintains strength as buyers defend the $0.58 support zone during a critical market setup.

- Market data shows steady gains with rising price action and controlled accumulation patterns.

- Seasonal S&P 500 data points to December strength following gains from September to November.

SPX6900 price action shows renewed strength as the market holds a crucial support zone and builds momentum after a period of steady accumulation. The structure forms during a key technical pattern that has gained market attention.

Reversal Pattern Develops Near Key Support

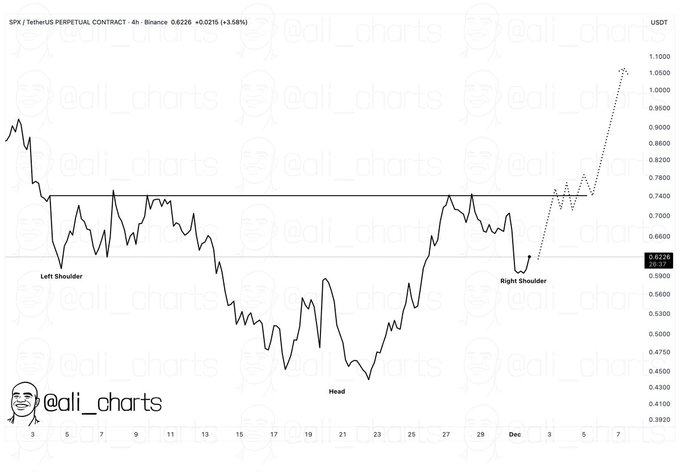

SPX6900 attracts attention after forming a potential inverse head-and-shoulders structure. The formation emerges as the market defends the $0.58 support area with steady engagement. The pattern begins with a left-shoulder formation during a consolidation phase marked by reduced momentum.

The mid-November decline establishes the head, which forms as selling pressure weakens near a rounded low. Buyers absorb supply and shift the direction toward a series of higher lows. This transition guides the market toward the right-shoulder region with improved behavior and measured compression.

Ali’s post notes that the $0.58 zone is the fulcrum of the entire structure. The neckline remains the essential boundary for confirmation, as repeated taps show decreasing rejection strength. If price moves above the neckline with volume, the projected target extends toward the $0.95–$1.05 zone.

Market Data Shows Strength Above $0.5982

SPX6900 as of writing, trades at $0.6701 after gaining more than 12% within the last 24 hours. The rise coincides with a successful reclaim of the $0.5982 area, which earlier acted as a critical test of demand. The reversal from that region marks a shift in trend direction and signals renewed activity among buyers.

Market cap increases to $623.94 million, moving in line with the price expansion. Volume declines by more than 21%, suggesting controlled accumulation rather than rapid speculative surges. This behavior supports a structured advance rather than an unstable breakout.

Circulating supply remains near 930.99 million tokens from a one-billion maximum. The tight supply profile keeps dilution risk low and supports stability. More than 219,000 holders maintain broad participation, reinforcing the current structure.

Seasonal S&P 500 Data Supports Broader Risk Appetite

Schaeffer’s Investment Research shares new seasonal data on the S&P 500. The report shows that when September, October, and November post combined gains, December often continues the trend. The average growth over the three months is around 3.49% and December provides another 2.03% growth.

The periods of 1998, 2004, 2013, and 2019 are examples of high follow-throughs following initial gains during the early years. The dataset contains only one major deviation. The broader pattern supports the view that momentum often extends through year-end if conditions remain stable.

The current year records a 1.98% gain from September to November. The reading aligns with past patterns that preceded further December strength. The market structure, combined with SPX6900’s rebound, reflects an environment where traders monitor seasonal activity closely.