Key Insights:

- Solana’s price rose by 2% to $142.27, signaling potential for further gains if the upward momentum continues.

- ETF inflows into Solana-based funds reached $55 million, with Bitwise’s BSOL ETF leading the charge.

- Solana DApps generated over $16 million in the past week, with Pumpfun and Ore contributing significantly.

Solana has shown resilience in the face of a slow crypto market, with its price surging by 2% in the past 24 hours, reaching $142.27. This increase follows a brief recovery, suggesting that the token is regaining strength. Despite the ongoing challenges in the broader crypto market, Solana remains well above the critical $140 level, indicating growing investor optimism. As the price rebounds sharply from a significant support zone, many traders are speculating that a more substantial trend reversal could be on the horizon.

In a notable development, Solana spot ETFs have seen significant inflows, surpassing $55 million in the last two weeks. The majority of this surge can be attributed to Bitwise’s BSOL ETF, which continues to attract investors. Other ETF issuers, including Grayscale, Fidelity, Vaneck, and 21Shares, have also contributed to the rising interest in Solana-based assets. These inflows mark the 16th consecutive day of positive movement, further highlighting the growing confidence in Solana’s future potential.

Rising Revenue from Solana DApps

Solana’s decentralized applications (DApps) have also been performing well, generating over $16 million in the past week. Among the top earners are Pumpfun and Ore, which made $9.85 million and $3.02 million, respectively. Despite a few losses, such as Axiom, the overall performance of Solana DApps underscores the increasing adoption and success of decentralized applications on the Solana blockchain. This revenue growth signals not only the token’s resilience but also its potential as a platform for decentralized finance and other use cases.

Technical Indicators Point to Bullish Momentum

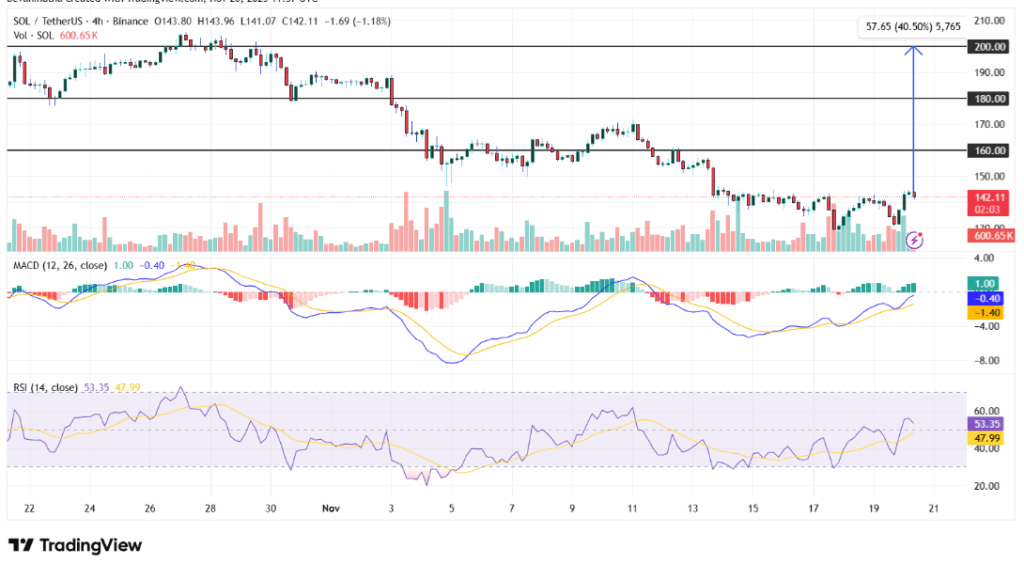

Technical analysis of Solana’s price chart reveals a favorable pattern, with the formation of a falling wedge that suggests the potential for an upward breakout. If Solana’s price manages to break through this pattern, analysts expect a strong recovery, potentially driving the token towards $157 or even higher.

The MACD indicator also supports this bullish outlook, as it shows a positive crossover, signaling continued upward momentum. Meanwhile, the Relative Strength Index (RSI) remains neutral at 53.65, indicating that the market could go either way, but the overall sentiment appears positive.