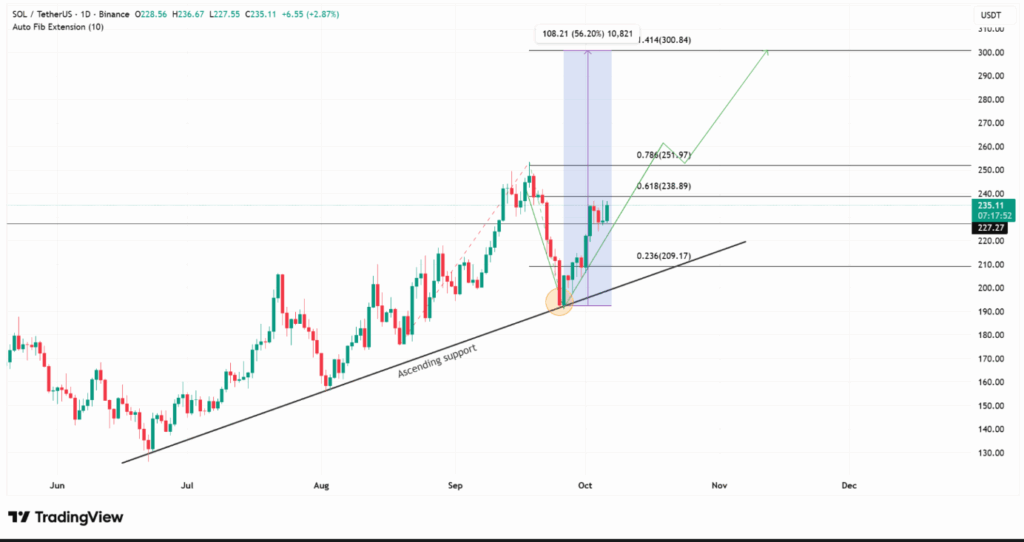

- Solana rose 3.57% to $236.46, holding firm above its ascending support line, reflecting renewed investor confidence and market strength.

- Institutional momentum increased as Solana Company added $530M in SOL to its treasury, tightening supply and supporting long-term valuation.

- Technical charts signal a strong path toward $300 if resistance at $251 is breached, supported by solid demand and structural resilience.

Solana recorded a notable 3.57% daily increase, reinforcing its ongoing uptrend as institutional demand resurges. The asset traded at $236.46, maintaining firm support along its ascending trendline that has guided price stability since mid-year. Market participants observed consistent buying strength, reflecting growing investor confidence in Solana’s resilience amid broader market shifts.

Technical analysis shows an ascending structure, with immediate resistance near $238. Sustained movement beyond this threshold could clear the way toward $251. Once the price maintains traction above that level, technical projections point to a potential rise toward $300, marking a 56% rebound from recent consolidation.

Moreover, Fibonacci extensions highlight key retracement levels where temporary pauses may occur. The 0.618 level at $238 remains a critical pivot, while the 0.786 zone near $252 could attract increased buying activity as traders position for continuation.

Support Levels Reinforce Market Structure

Despite intermittent fluctuations, Solana continues to hold above its major support zone near $227. A drop below this level could trigger a retest of the $209 area. However, the sustained higher-lows pattern supports a bullish structure, suggesting that accumulation remains active as buyers defend key technical zones.

Daily chart patterns further confirm this ongoing trend, showing consistent strength in price action and forming the foundation for a possible breakout if momentum sustains beyond short-term resistance.

$530M Corporate Purchase Strengthens Institutional Backing

Confidence in Solana’s long-term value deepened after Solana Company disclosed a $530 million addition of SOL to its treasury. The Nasdaq-listed firm’s acquisition ranks among the largest corporate purchases of Solana to date, signaling growing institutional recognition of the network’s scalability and performance efficiency.

Additionally, the recent enhancement of Grayscale’s Solana Trust (GSOL) to include staking opportunities has expanded access for institutional participants. This advancement aligns with the broader adoption trend across blockchain assets, offering high transaction throughput and cost efficiency.

With strong technical support and heightened institutional exposure, Solana remains positioned for further upward movement. A decisive close above $251 would confirm bullish continuation and potentially pave the way toward the $300 mark. As accumulation deepens and corporate participation increases, Solana continues to demonstrate sustained market resilience.