Key Insights:

- Solana has seen a notable price increase, currently sitting at $137, as institutional investments push ETF inflows to $621 million.

- Major institutions like Bitwise, Grayscale, and Fidelity are driving Solana’s ETF growth, reflecting a strong confidence in its future.

- Franklin Templeton’s filing for a Solana ETF signals growing interest from traditional finance, further solidifying Solana’s place in the digital asset market.

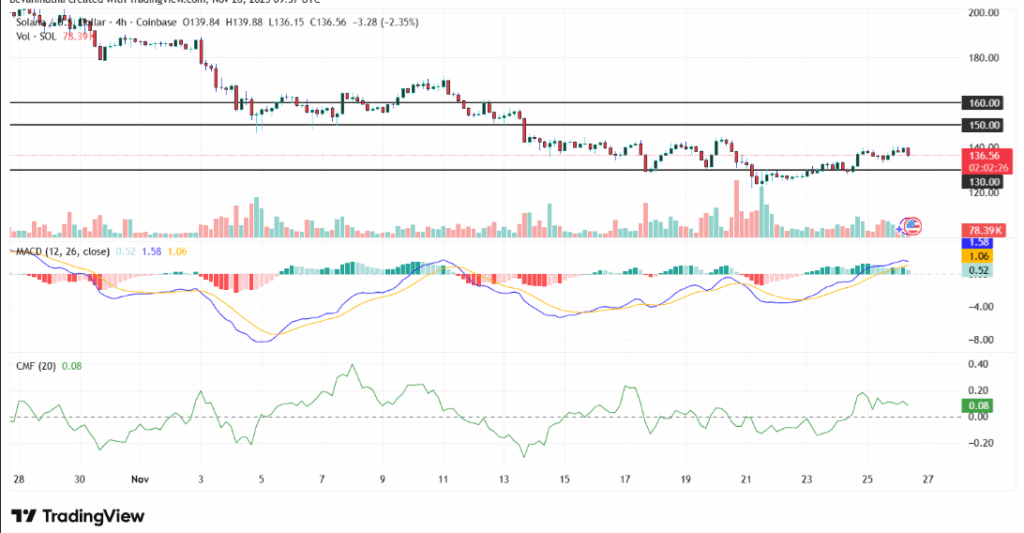

Solana’s price is on the rise, currently hovering around $137, following a modest increase of 2% over the past 24 hours. The cryptocurrency has gained significant attention due to institutional investments, notably through Exchange-Traded Funds (ETFs). With an influx of $621 million in ETF investments over just 21 days, Solana is showing promising signs of potential growth, and a move towards the $150 mark appears possible.

Recent ETF inflows into Solana have been substantial, with $53.1 million added on November 25 alone. This marks a continuation of a positive trend since the launch of these Solana-focused ETFs. Leading institutional investors are showing growing confidence in Solana’s ecosystem. Bitwise, for example, made a substantial $31 million contribution, while Grayscale followed with $16 million. Other major firms, including Fidelity and VanEck, have also joined the trend, further validating Solana’s position within the broader crypto market.

ETF Surge Reflects Growing Institutional Confidence

The total amount invested in Solana ETFs has now reached $621 million, a clear sign of increasing institutional interest. This surge in institutional investment is seen as a reflection of a growing belief in the long-term potential of Solana. With the market leaning toward ETFs as a safer way to enter the crypto space, these investments provide a solid foundation for Solana’s future price movements.

In a noteworthy development, Franklin Templeton, a major player in traditional finance, has filed for a Solana ETF with the U.S. Securities and Exchange Commission (SEC). This filing, marking a key step in the process, signals the growing interest from conventional financial institutions in digital assets. The upcoming Solana ETF, expected to be listed on the NYSE Arca, could add further momentum to Solana’s market position.

Solana Price Outlook: Path to $150

At present, Solana’s price appears poised for continued upward momentum. While the MACD indicator suggests bullish pressure, the market’s overall sentiment will be key. If Solana manages to hold above its current support level around $130, a break above $150 remains a strong possibility in the coming weeks. However, market fluctuations and institutional activity will continue to influence price direction.