Key Insights:

- Solana has declined over 26% in a week and slipped below the $90 mark under strong bearish momentum and broader market pressure.

- Despite the price dip, Solana ETFs saw $5.6 million in inflows, led by BSOL, signaling continued institutional interest in SOL.

- January saw a surge in Solana-based token launches, with over 1.3 million new SPL tokens created, marking peak network activity.

Solana’s price declined sharply in the past 24 hours, registering an 8.28% drop and falling below $95 for the first time since February 2024. By early February 5, SOL traded at $89.21, marking a steep 26.77% decline in the past seven days. The drop reflects continued weakness in the broader crypto market.

Amid the sell-off, trading volume in Solana rose significantly to $7.1 billion, recording a 73.79% increase. This indicates elevated market activity, largely driven by long liquidations and forced exits. The global crypto market also declined by 4.08% to a valuation of $2.5 trillion, with Bitcoin and Ethereum falling 5% and 6% respectively. Other major altcoins such as BNB, XRP, ADA, and DOGE faced similar downward trends.

Solana ETFs Attract Inflows Despite Downtrend

Solana-related ETFs reported net inflows of $5.6 million on February 2. The Bitwise Solana Staking ETF (BSOL) led with $3.4 million in new capital, followed by inflows into funds like Fidelity’s FSOL and Grayscale’s GSOL. This increase brought Solana ETF inflows to a total of $887 million. Despite retail selling pressure, institutional investment remains active.

The Solana blockchain witnessed over 1.3 million new token launches in January, marking its highest monthly figure in the past year. These tokens, created within the SPL ecosystem, highlight continued developer activity and protocol use despite price headwinds. Token deployment remained steady throughout the month with multiple high-volume days.

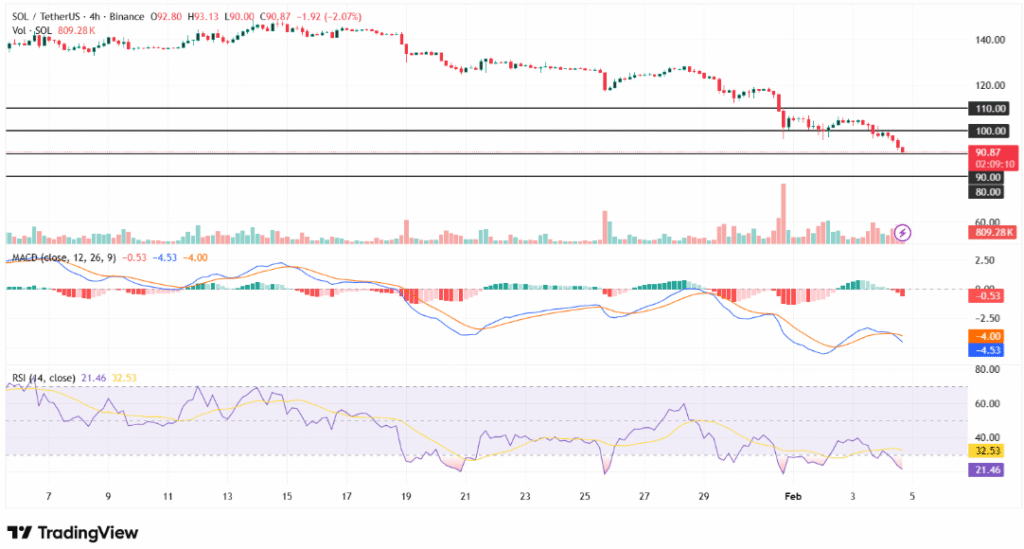

Indicators Point to Continued Weakness as $90 Becomes Crucial

At press time, SOL is hovering near $92.32, testing support at $90. Analysts note that if this level fails to hold, a decline toward $80 is likely. Momentum indicators such as the MACD remain bearish, with the histogram reflecting downward pressure. The RSI is currently at 21, signaling oversold conditions that may allow for a short-term recovery.