Key Insights

- Solana forms a strong cup and handle structure, signaling a possible breakout toward $1,300 as buying momentum intensifies.

- Solana Company plans to acquire 5% of SOL supply, tightening liquidity and reinforcing institutional participation.

- Expanding initiatives in Asia, including a Solana Treasury Company in Japan, highlight the network’s growing global institutional reach.

Solana continues to attract growing attention from traders and analysts as strong technical patterns emerge alongside increased institutional activity. The cryptocurrency’s price action reflects a well-established bullish setup, suggesting that a significant move could be underway in the coming months.

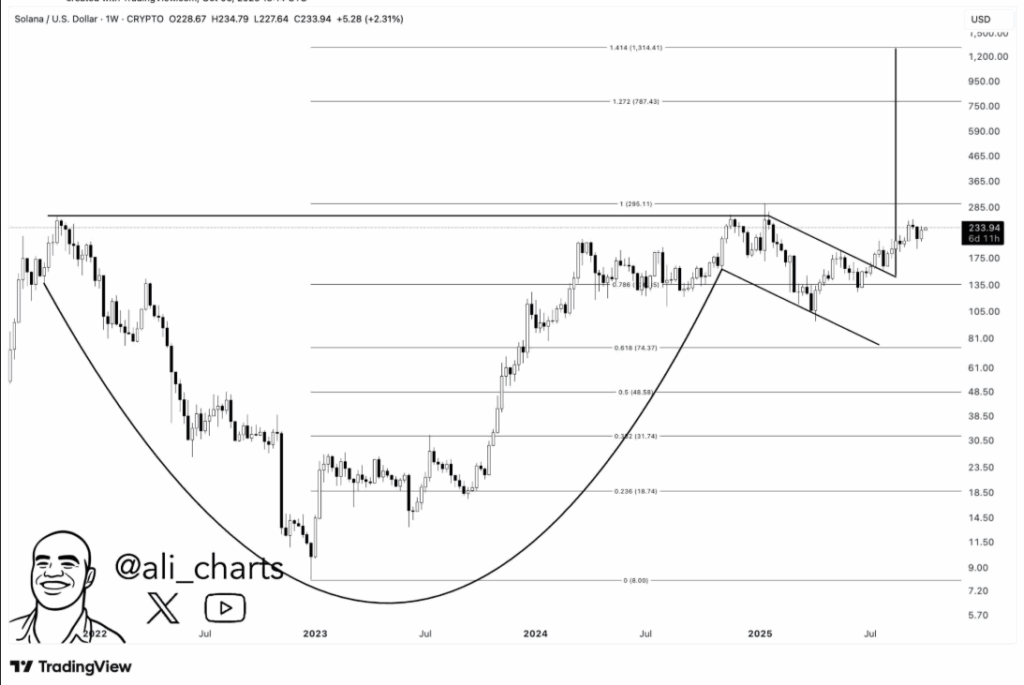

Market strategist Ali Charts has identified a large cup and handle structure on Solana’s weekly chart, supporting projections of a potential rise toward $1,300. The pattern began forming in 2022 near $285 and developed a rounded base around $18 by mid-2023. From there, Solana advanced through 2024, reaching about $230 in early 2025, completing the cup shape.

The handle formation followed as a brief consolidation phase marked by a descending channel. Significantly, Solana broke above this channel in July 2025, indicating early signs of a breakout. The token currently trades near $223, slightly below the neckline resistance at $285. A confirmed break above that level could validate the bullish continuation pattern and reinforce the long-term positive outlook.

Institutional Confidence Strengthens Market Sentiment

Institutional interest has further boosted optimism around Solana’s trajectory. Solana Company recently announced plans to acquire 5% of the network’s total supply, expanding its already substantial holdings. The acquisition aims to consolidate strategic control while deepening collaboration with Pantera Capital and the Solana Foundation.

Such large-scale accumulation is expected to reduce available liquidity, which could magnify price movements during bullish phases. Moreover, these institutional actions underline growing confidence in Solana’s long-term value proposition.

Asian Market Expansion Boosts Global Presence

Beyond the acquisition plans, Solana’s ecosystem is gaining traction in Asia. Nasdaq-listed DeFi Development Corp has launched Japan’s first Solana Treasury Company in partnership with Superteam Japan. This initiative, under the Treasury Accelerator Program, enables regional institutions to manage Solana-based treasuries efficiently.

Furthermore, Solana Company’s intention to pursue a public listing in Hong Kong highlights its increasing corporate influence and expanding market integration.

Solana’s blend of technical strength and institutional growth continues to define its market appeal. A sustained breakout above $285 could confirm a broader bullish phase, aligning with projections that see Solana advancing toward $1,300 in the long term.