- Sei shows bullish RSI divergence, indicating fading selling momentum and early signs of market stabilization.

- Traders eye $0.21 for confirmation of a potential rebound following a 25% decline in recent weeks.

- RSI between 30–35 signals oversold territory, attracting short-term buyers seeking a possible price recovery.

Sei is showing early signs of recovery after weeks of steady losses. The asset’s momentum has begun to shift, with technical readings suggesting that selling pressure may be fading across short-term charts.

RSI Divergence Hints at Reversal Potential

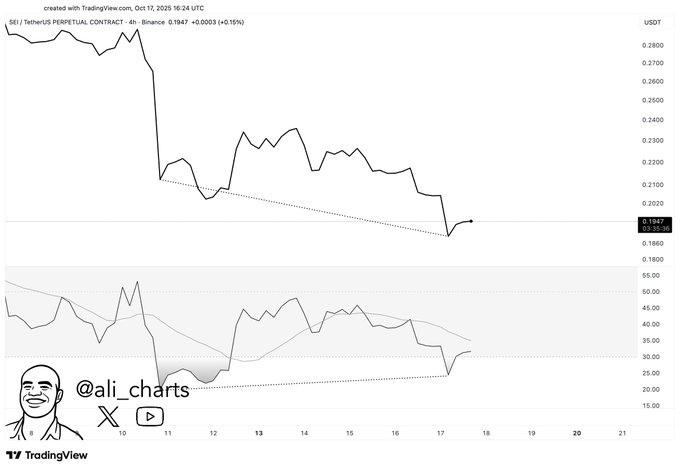

A recent post by analyst Ali (@ali_charts) stated, “Sei is showing a bullish divergence on the RSI. A rebound could be closer than most expect.” His observation follows a clear pattern seen on the 4-hour SEI/USDT chart, where prices have been falling but the relative strength index (RSI) has started to form higher lows.

This pattern is known as a bullish RSI divergence, a signal that often appears when selling momentum begins to lose strength. Sei has dropped from around $0.26 to near $0.195, a decline of roughly 25%, but the RSI’s gradual recovery suggests that downward pressure may be easing.

The chart structure shows descending trendlines on price while the RSI slopes upward. This divergence zone often develops before short-term rebounds as market sentiment slowly begins to stabilize.

Market Data Reflects Stabilization and Caution

Sei as of writing, is priced at $0.1940, which is down 0.25% over 24 hours. It has a $1.21B market cap which is also the unlocked market cap, and the fully diluted valuation is $1.94B.

The 24-hour volume is down nearly 38% to $133.7 million. This shows weakness in trading with indecision by investors. The circulating supply of tokens is 6.24 billion SEI, out of a total of 10 billion tokens. This means that 62% of the total token supply is circulating and allows for sufficient liquidity in the market.

The price is still trying to find support around $0.192, while Sei continues to consolidate. The RSI is nearing 30 – 35, which is in the oversold range. This range has been known to introduce short-term buyers who think the price will bounce back.

Key Levels Define the Next Move

Traders are watching the $0.18–$0.19 area closely for support, which has attracted buying interest in the past. If Sei closes above $0.205–$0.210 with volume bigger than the previous bar, momentum may have shifted and it could signal upside towards the $0.23–$0.25 area if buying continues.

A drop below $0.186 would invalidate this bullish divergence and suggest sellers have stepped back into control, which remains the key invalidation level for short-term bullish setups.

Sei’s RSI divergence implies momentum is stabilizing–despite volume being lower–and if confirmed with volume on the buy side, it could mark an early stage of short-term recovery following weeks of diminishing prices.