- SEI approaches a major resistance at $0.22, where long-term trendline pressure continues to guide market direction.

- SEI displays narrowing downside momentum as buyers slowly absorb liquidity near current trading zones.

- SEI shows increased volume and steady price recovery, hinting at stronger positioning ahead of key market levels.

SEI is shaping a crucial phase as price action narrows beneath a long-standing trendline that continues to guide overall direction. Recent intraday activity and broader structural shifts show a market preparing for its next decisive move.

Macro Trendline Pressures Continue

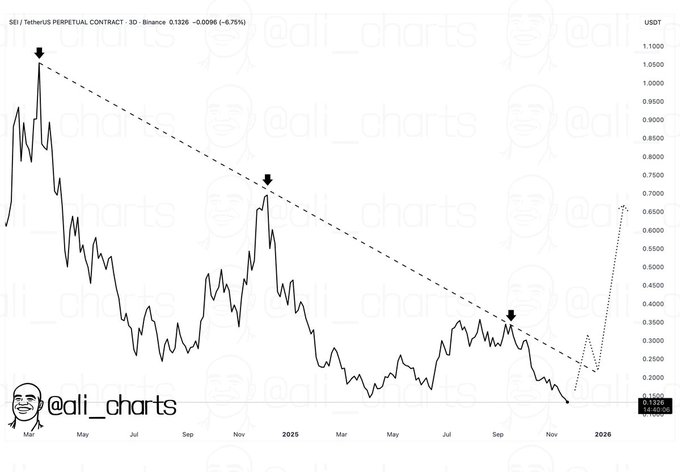

SEI remains positioned beneath a major descending resistance that has influenced its structure since early 2024. The chart shared by Ali shows three clear reactions marking each touch along this trendline. Each rejection established a lower high and kept price contained within the broader decline.

The earlier rejection near the 2024 high initiated a firm move downward and defined the pattern for the following months. Another touch later in the year maintained the bearish slope, indicating steady control from sellers along the same structure. A third reaction in 2025 reinforced the trendline and guided SEI back toward lower support levels.

SEI now trades near $0.13, situated just below the critical $0.22 resistance that serves as both a horizontal barrier and the underside of the long-term trendline. This level must be cleared for any broader shift, and until that occurs the market remains aligned with the existing downtrend.

Sector Convergence Adds Context to Future Movement

SEI also appears within a larger narrative involving AI expansion and new blockchain infrastructure growth. Commentary from AshCrypto shows how SEI and FET contribute to the evolving AI sector, with each token supporting different layers of emerging digital systems. This environment creates a backdrop for potential long-term interest.

FET brings computational processes that assist machine coordination, while SEI provides higher throughput required for rapid execution in AI-enabled frameworks. Their combined presence forms a structural base for new blockchain applications built around automation and data-driven systems. This intersection is gaining attention as adoption expands.

Camp Network introduces another layer by addressing verified ownership for AI datasets. It brings an authenticated registry for creators and brands, supporting licensed use and secure distribution. This model demonstrates how new infrastructure may support technological growth while reinforcing proper data sourcing across digital platforms.

Intraday Activity Shows Shifting Momentum

SEI as of writing traded near $0.1364 in the latest session, posting a small advance while handling earlier volatility. Trading volume rose more than 33%, pushing activity toward $96 million and showing renewed interest after a brief selloff near $0.132. This move suggested buyers were prepared to defend lower zones.

Price recovery carried SEI toward $0.138 before meeting short-term resistance. The pullback into the $0.136 region displayed orderly behavior as the market attempted to form a base rather than revisit earlier lows. This pattern indicates a measured shift as participants manage bids within a tighter range.

Compression near the end of the session, paired with an 11.09% volume-to-market-cap ratio, sets the stage for another directional move. With circulating supply near 6.37 billion and FDV at $1.36 billion, SEI retains capacity for swift moves when sentiment changes. Attention now shifts back to the $0.22 trendline as the next test.