- PUMP holds critical support near $0.0050 as traders eye a bounce or deeper accumulation near $0.0040.

- Strong trading volume and DeFi presence support long-term potential despite short-term volatility.

- Resistance at $0.0070 remains the barrier before a possible rally toward $0.012 in the medium term.

Pump (PUMP) is forming up following a sharp market correction, the token is currently testing key levels of support which may determine its next course of action. Close interest is held by the traders and long term investors as to whether the momentum can now turn upward or whether further retracement is in store.

Support Levels Define the Current Setup

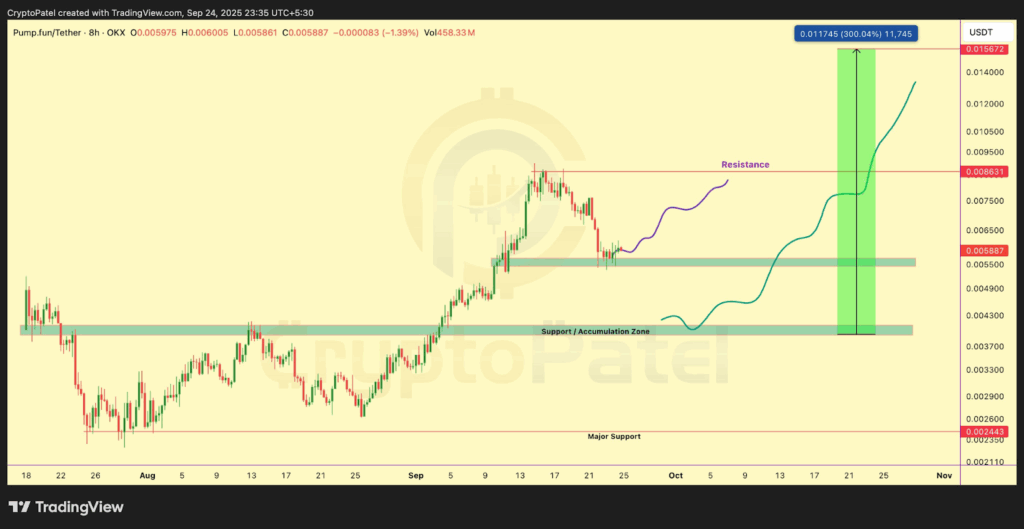

Crypto Patel (@CryptoPatel) noted that PUMP is currently holding above its immediate support zone between $0.0050 and $0.0055. This region previously acted as a launchpad for a strong rally, and its defense is vital for bullish continuation. Traders are focused on whether buyers can sustain momentum at this level.

If support holds, the path for renewed accumulation strengthens. Patel explained that there are better entry opportunities within the range of $0.0040-$0.0038 and the market has already demonstrated good demand at this level. This is seen by many traders as a critical accumulation zone that may come up with the next leg upward.

But once price decreases below the $0.0051 level, chances increase that price will test to $0.0040. Although this would prolong the period of consolidation, it would not remove the wider structure upwards. For committed participants, such dips still offer accumulation potential in a volatile but growing market.

Resistance Zones and Short-Term Trading Outlook

The immediate resistance band is set between $0.0068 and $0.0070, where earlier bullish momentum was rejected. This area represents the barrier that must be cleared for any upward extension. Traders anticipate that breaking this ceiling would validate renewed buying strength.

A confirmed move above resistance would open room toward the $0.012 level in the short to medium term. This scenario represents nearly 100% upside from current support, making it a closely monitored pivot for momentum traders. Strong trading volume, which reached $555 million in 24 hours, reinforces the possibility of sharp swings once levels are breached.

As of the time of writing, PUMP trades at $0.005245, showing a 9.7% daily decline. The correction from a peak of $0.00600332 has steadied, and minor rebounds indicate buyers are attempting to regain control. Whether these efforts succeed depends on maintaining present support while absorbing selling pressure.

Broader Market Position and Long-Term Targets

Beyond technical setups, PUMP maintains a market capitalization of $1.85 billion, with a fully diluted valuation of $5.24 billion. Circulating supply stands at 354 million tokens against a maximum supply of 1 billion, raising future dilution considerations.

DeFi’s presence remains visible, with $286 million in Total Value Locked. This establishes that the token holds utility within decentralized applications, adding depth beyond speculative trading. Strong liquidity and active participation suggest that interest extends across both short-term and longer-term holders.

Patel’s longer-term projection places PUMP at $0.10, representing a possible tenfold return from accumulation zones. While ambitious, this target aligns with the larger trend structure if the asset sustains demand and breaks major resistance. Such a path requires patience but underscores the potential within its broader trajectory.