- PENGU shows a TD Sequential buy signal after nine consecutive bearish candles.

- Price faces critical support near $0.029, with buyers showing dip interest.

- Long-term metrics remain strong despite short-term weakness and heavy selling.

Pudgy Penguins (PENGU) is showing early signs of exhaustion after a prolonged selloff, with the TD Sequential indicator flashing a buy signal. Traders are closely monitoring $0.029 support as sentiment shifts between weakness and potential recovery.

TD Sequential Suggests Potential Market Reversal

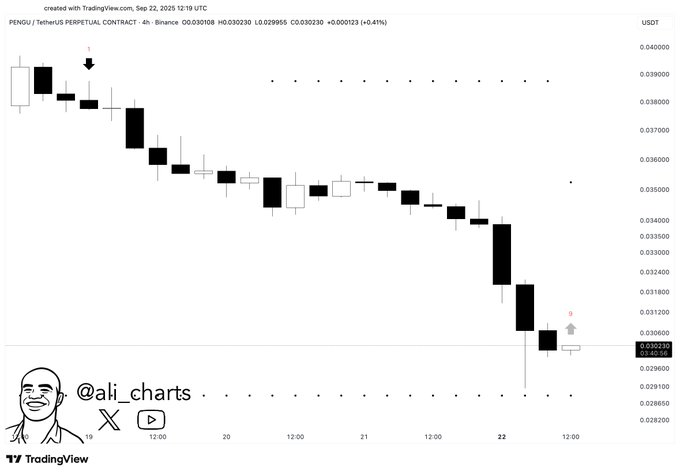

The 4-hour chart for PENGU/USDT has displayed consistent bearish movement since mid-September, creating a series of lower highs and lower lows. Selling intensified between September 21–22, driving price from $0.034 to lows near $0.029.

Ali (@ali_charts) pointed out that the TD Sequential indicator has now triggered a buy setup after nine consecutive bearish candles. Historically, this signal often suggests that bearish pressure may be reaching exhaustion. Traders view this as an early opportunity for strategic accumulation.

Recent candles show shorter bodies and long lower wicks, suggesting selling momentum is weakening. If $0.029 holds as a floor, a rebound toward $0.032–$0.034 could form, which previously acted as resistance. However, failure to sustain support could extend the correction toward $0.02820.

Performance Metrics Show Mixed Outlook

As of the time of writing, Pudgy Penguins trades at $0.03013, reflecting a 2.66% decline over 24 hours and an 8.36% drop over seven days. Intraday trading has been unstable with downward spikes that have momentarily tested the level of $0.02975 followed by partial reversals.

The token has fallen 16.92% over the last 30 days, and yields year-to-year results of a decline of 9.61% These figures reflect ongoing stress in recent meetings. Nevertheless, the overall development is positive, where 90-day returns stand at 203.20% and 180-day returns stand at 331.66.

Even at the one-year level, PENGU is up 5.87%, which is an indication that although the short-term performance is under strain, the longer-term growth trends are not disrupted. This two-sided perspective is representative of short-term weakness in a broader upswing direction.

Market Sentiment and Key Levels Under Watch

Market positioning varies across exchanges. On Binance, the long/short ratio for PENGU stands at 1.7382, while top traders post a similar bias at 1.6455. This implies that the majority of the participants are looking at recovery even in the face of near-term weakness.

In OKX, sentiment is less aligned, the ratio stands at $0.96, which indicates more balanced or cautious positioning. The variance in exchanges indicates that market positions can be subject to localized liquidity and trader actions.

Key support remains at $0.029. A decline might beckon the further approach to $0.02820 and the re-gaining of $0.034 through volume would turn the tide to sellers. These thresholds are being closely monitored by traders in order to ascertain the next directional move.