- PEPE is trading around $0.000006892 as it is experiencing divergent technical formations which indicate bearishness as well as possible recovery.

- A confirmed head and shoulders breakdown could send PEPE toward $0.00000185 if the neckline fails to hold.

- The optimistic traders look at a symmetrical triangle breakout to hit at $0.00001811 provided the volume and sentiment sustain.

Pepe (PEPE) continues to attract market attention as technical signals point toward contrasting outcomes. While some chart structures suggest a looming bearish phase, others indicate potential recovery, creating a divided outlook across the crypto community.

Bearish Structure Emerges on Medium-Term Chart

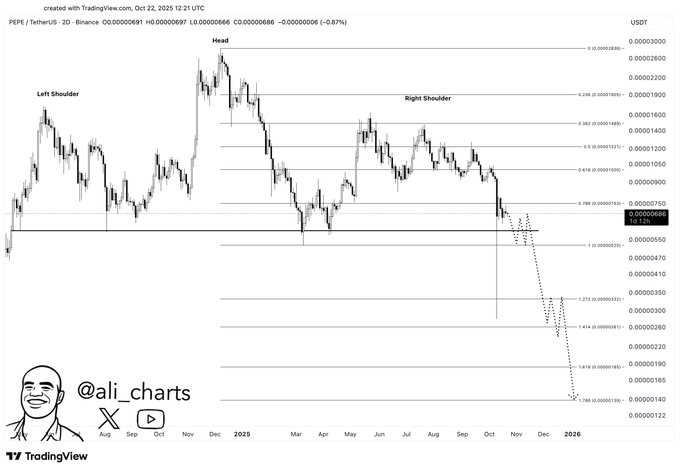

A recent chart analysis from @ali_charts reveals a clear head and shoulders pattern forming on the PEPE/USDT two-day timeframe. This formation, often considered a bearish reversal, reflects a shift from prior bullish conditions toward a phase of weakening demand. The setup follows an extended uptrend where price momentum began to fade as sellers gradually regained control.

This pattern has a left shoulder formed in July-October 2024 following an initial burst and short consolidation. The head was formed in December 2024, as PEPE neared its highest level of around $0.0000028 to $0.0000030, and then fell to the start of early 2025. The neckline set at around $0.00000075 has since served as a very important horizontal support level in determining the structural boundary between continuation and reversal.

The right shoulder that is seen in the period of April to September 2025 has successively growing lower highs with rejections at some of the major Fibonacci retracement levels. Prices now trading at a price below the neckline of around $0.00000066, a breakdown would be a confirmation that would project the downside target at around $0.00000185. Analysts observe that this action coincides with the Fibonacci 1.618 Fibonacci extension level, where there might be a retracement level in case bearish influences continue.

Mixed Conditions are Market Sentiment and Volume.

Technical weakness notwithstanding, greater sentiment on PEPE is favourable. According to the coin market cap data, the token is trading at $0.000006892, which represents a small 1.37% gain per day and a market capitalization of 2.89 billion dollars. Nevertheless, the volume of trade 24 hours trading has decreased by 11.43 to about $477 million, which is an indication that the speculative action has been lessened following a volatile situation.

The sentiment index of the platform indicates the presence of a bullish majority of 87% which indicates that the traders are optimistic despite the conflicting chart structures. This optimism stems largely from PEPE’s community-driven strength and established cultural presence in the meme coin space. Such sentiment often provides short-term support as investors anticipate potential rebound opportunities.

Yet, volume metrics provide a more neutral perspective. The 16.44% volume-to-market cap ratio suggests active trading but not strong accumulation pressure. Sustained inflows and heightened liquidity would be required to confirm renewed upside momentum, particularly following recent structural breakdowns observed on higher timeframes.

Bullish Scenario Builds Around Symmetrical Triangle Formation

On a shorter-term technical outlook, analyst ELARA shared that PEPE is nearing the apex of a symmetrical triangle pattern. This structure typically signals coiling volatility ahead of a breakout, with direction depending on forthcoming market confirmation. If PEPE breaks above the descending resistance trendline, the measured move could target $0.00001811, indicating a potential 160% rally from current price levels.

The pattern’s strength relies on volume expansion accompanying any breakout. The lack of such confirmation means the structure will transform into another formation of lower high. It is determined that the immediate support is between $0.0000065 and $0.0000067 which is a critical defense area of the bulls to maintain the momentum. Any close below the level will nullify the optimistic forecast and leave space to retest the level again at $0.0000055.

PEPE has a large number of holders of more than $490,000 and a wide market share and liquidity. This holder base offers long term stability but can also be subject to volatility as short term traders respond to the shifting sentiment. As of today, the market has been on a determining crossroad- at least the directionality will be determined by the next successful breakout point of either the head and shoulders breakdown or the symmetrical triangle breakout.