Key Insights:

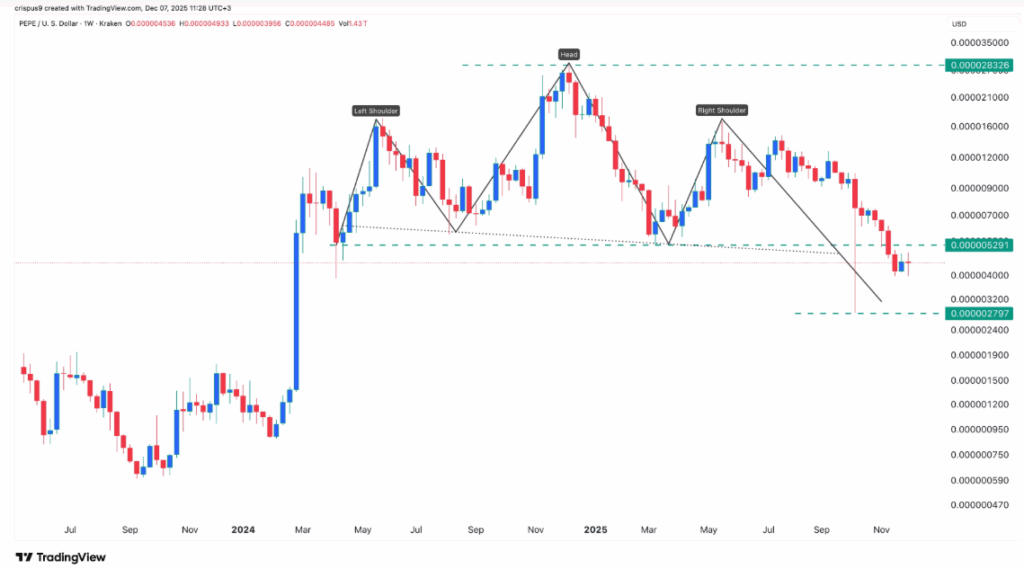

- Pepe Coin’s price struggles below a key support level as it forms a bearish head-and-shoulders pattern on the weekly chart.

- Despite the bearish technical outlook, whale accumulation continues, with holdings rising by 30 billion tokens in recent weeks.

- The exchange supply of Pepe Coin has dropped significantly, indicating investor confidence and potential for future price recovery.

Pepe Coin (PEPE), a major player in the Ethereum meme coin market, continues to face significant pressure below a critical support level. Despite the ongoing accumulation by whales, the coin’s price has been sliding. Recently, it dropped to $0.000004512, marking an 85% decrease from its highest point this year. This puts the token near its lowest value since April of last year. While the broader cryptocurrency market struggles, meme coins, including Pepe, Shiba Inu, and Dogecoin, have seen sharp declines.

On the technical front, Pepe Coin has formed an alarming head-and-shoulders pattern on its weekly chart. This pattern is a traditional signal for bearish trends, which suggests the token could face further losses in the near future. The critical support level at $0.0000052 has already been breached, confirming the downward pressure on the price. The head-and-shoulders formation has its peak at $0.00002832 and its shoulders at $0.00001665, reinforcing the idea of a potential breakdown.

Whale Activity Suggests Rebound Possibility

Despite the price struggles, there are signs that whales remain confident in Pepe Coin’s future. Data from Nansen shows that whale holdings have increased to 4.44 trillion tokens from 4.41 trillion in November. This uptick suggests that large investors are still buying the token, with 30 billion more tokens added to their holdings in recent weeks. However, some smart money investors have begun to reduce their holdings, indicating a mix of sentiment among larger players.

Interestingly, the supply of Pepe Coin on exchanges has continued to decrease, which could indicate that investors are buying the dip and holding onto their tokens. Current data shows that exchange supply has dropped to 258.2 trillion tokens, down from a peak of 259.10 trillion last month. This decline in supply suggests that traders may be moving their holdings off exchanges, a sign that many are expecting the coin’s value to rebound over time.

Declining Holdings Among Smart Money Investors

Despite the overall whale accumulation, the “smart money” category of investors has been reducing their exposure to Pepe Coin. Smart money investors currently hold 182.17 trillion tokens, down from 184.47 trillion at the start of the month. This drop in holdings may suggest some caution among the more experienced traders, although the ongoing whale accumulation offers some hope for the token’s future.

Pepe Coin’s price movement over the past few months has reflected broader market trends, with meme coins particularly feeling the effects of the ongoing crypto downturn. While the token’s technical indicators show bearish potential, the continued accumulation by whales and a decreasing supply on exchanges offer some optimism for the future.