Key Insights:

- Ondo’s price recovery is fueled by MetaMask’s integration of over 200 tokenized U.S. stocks and ETFs, signaling broader DeFi adoption.

- With a 2.68% increase in the past 24 hours, Ondo shows signs of a comeback despite the wider market decline.

- The addition of tokenized U.S. stocks opens a new frontier for users to trade traditional assets without a brokerage account.

Ondo (ONDO) has seen a positive shift in its price recently, moving upwards to $0.29 after a brief dip. This change comes despite the broader crypto market experiencing a 0.98% decrease, dropping to a market cap of $2.59 trillion. ONDO’s 2.68% rise in the past 24 hours suggests that it may be recovering from its earlier bearish trends.

MetaMask, the popular Ethereum wallet, recently added over 200 tokenized U.S. stocks, ETFs, and commodities to its platform. This integration allows users in non-U.S. markets to buy and sell tokenized assets like Tesla, Apple, and Microsoft stocks, as well as precious metal ETFs such as SLV (silver) and IAU (gold). Ondo Finance, in partnership with MetaMask, enables users to access these tokenized assets without needing a traditional brokerage account.

This announcement, made at the Ondo Global Summit, highlights a significant step forward in the convergence of decentralized and traditional finance. Ondo Finance has positioned itself as the largest platform in this category, boasting a portfolio worth $2.5 billion and more than $9 billion in trading volume.

Growth and SEC Compliance: Ondo’s Future Outlook

Ondo Finance is also working towards meeting the U.S. Securities and Exchange Commission’s (SEC) requirements, which marks an important milestone for the tokenization of U.S. stocks and other real-world assets. This integration indicates a shift towards the mainstream adoption of decentralized finance (DeFi), aligning tokenized securities with traditional financial structures.

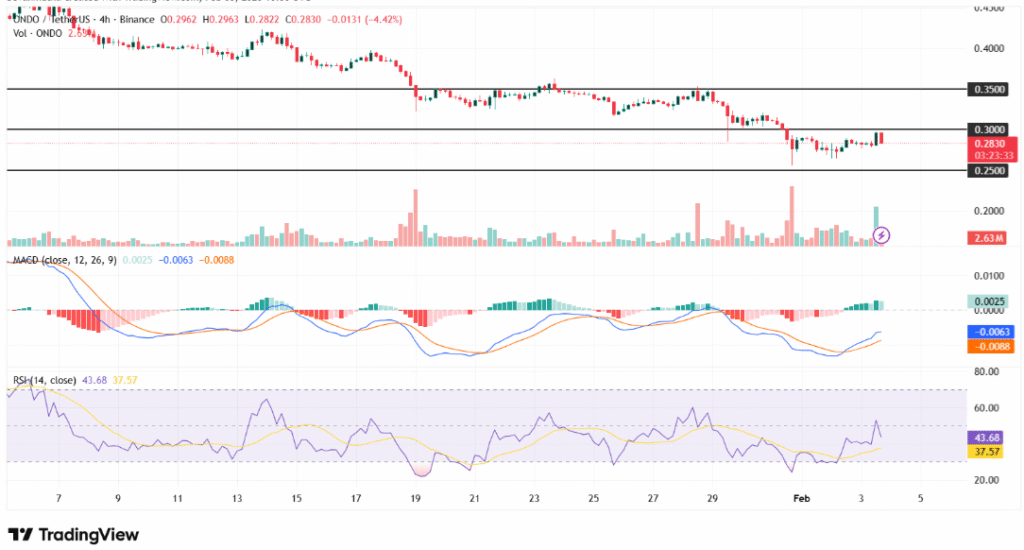

As of the latest data, the price of ONDO stands at $0.29, experiencing a slight 0.4% decline. In recent days, the price has fluctuated between $0.25 and $0.35. The Moving Average Convergence Divergence (MACD) indicator suggests a negative trend, while the Relative Strength Index (RSI) is at 43.85, indicating a neutral market position.

Support for ONDO can be seen around the $0.25 level. If the price drops below this mark, a further bearish trend may be triggered. On the other hand, a break above the $0.35 resistance level could signal the start of an upward trend, with potential targets of $0.40 in the near future.

Market Recovery: Ondo’s Role in DeFi Growth

Despite the overall downturn in the cryptocurrency market, Ondo’s recent rise shows a potential recovery, driven by MetaMask’s latest integration. This collaboration suggests that tokenized U.S. stocks could play a key role in the continued growth of decentralized finance, offering a new way for investors to participate in both traditional and crypto assets.