- Lido DAO (LDO) is retesting its breakout zone after leaving a horizontal channel, with support holding above $1.15.

- Trading volume increased 28.77% in 24 hours, suggesting growing participation as price consolidates near the $1.19 region.

- Market Cap-to-TVL ratio at 0.02869 shows LDO remains undervalued relative to its $37.26 billion locked assets.

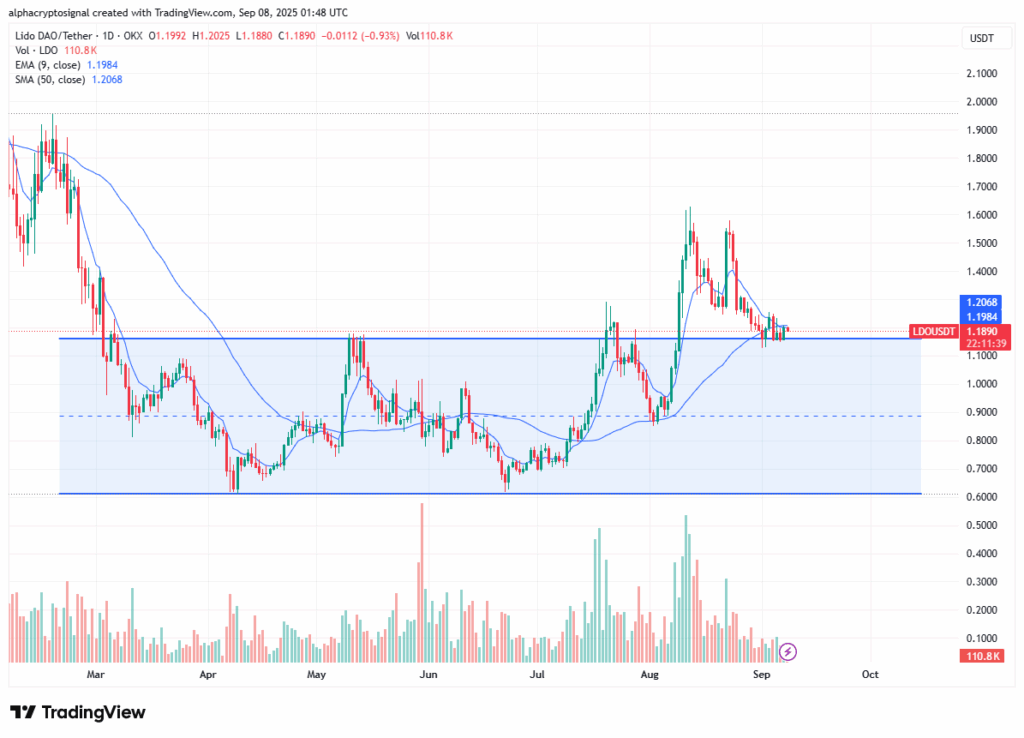

Lido DAO (LDO) is no longer stuck in a protracted period of consolidation, and it is retesting its breakout zone. This level has changed its resistance to support, and its stability can be the decisive factor between a bullish continuation and a momentum decline.

Breakout Retest in Focus

The daily chart of Lido DAO shows a clear breakout from a horizontal channel that had capped price movement for months. Alpha Crypto Signal (@alphacryptosign) noted that LDO is currently hovering above its former resistance, now acting as support. This retest is a critical point for the token’s next direction.

The breakout itself occurred with improving volume, an encouraging sign of buyer participation. Now the key test is whether the market can absorb profit-taking and stabilize above the retest zone. If sustained, this structure remains valid and could enable further upside movement in the coming sessions.

This is also supported by moving averages with the 50-day simple moving average and the 9-day exponential moving average approaching the retest area. Their gearing offers dynamic reinforcement and makes the more general bullish argument of continuation stronger.

Market Structure and Key Levels

At the time of writing, LDO is trading at $1.19, recording a 2.46% daily gain. The intraday low of $1.1661 was quickly defended, with price recovering to test highs around $1.21. Such rebounds often suggest that buyers are defending key demand levels.

Volume surged 28.77% in 24 hours to $66.87 million, reflecting growing participation from traders. Market capitalization stands at $1.06 billion, closely aligned with the unlocked market cap of $1.07 billion. This balanced structure limits dilution risk and reflects steady token distribution.

The traders are monitoring $1.15-$1.17 as short-term support. Once it breaks out of the thermal resistance at above $1.21, it might open the door to $1.25-$1.30. Failure to hold the support, however, would likely return the token to the prior channel.

Fundamental Strength and Valuation

Beyond price action, Lido DAO maintains its dominance in DeFi as the leading liquid staking protocol. Its total value stands at $37.26 billion, securing a strong position within Ethereum staking markets. This foundation supports LDO’s relevance in both short-term trading and long-term strategies.

The circulating supply of $895.93 million out of 1 billion total tokens reduces risks of sudden large-scale supply inflation. Combined with the active trading environment, liquidity remains sufficient for both retail and institutional players.

The most interesting of them is perhaps the Market Cap-to-TVL ratio of 0.02869, which indicates that it is understated relative to the assets that it secures. Such metrics are historically of strategic interest, especially to investors who want assets with good fundamentals but low valuations.