Key Insights

- HYPE price maintains a short-term uptrend above key Fibonacci levels with widening volatility indicators backing the momentum.

- Open interest has begun rising again after a reset, reflecting a cautious return of leveraged traders without excessive risk.

- Hyperion’s treasury strategy introduces a yield model by deploying HYPE into structured on-chain options via the Rysk protocol.

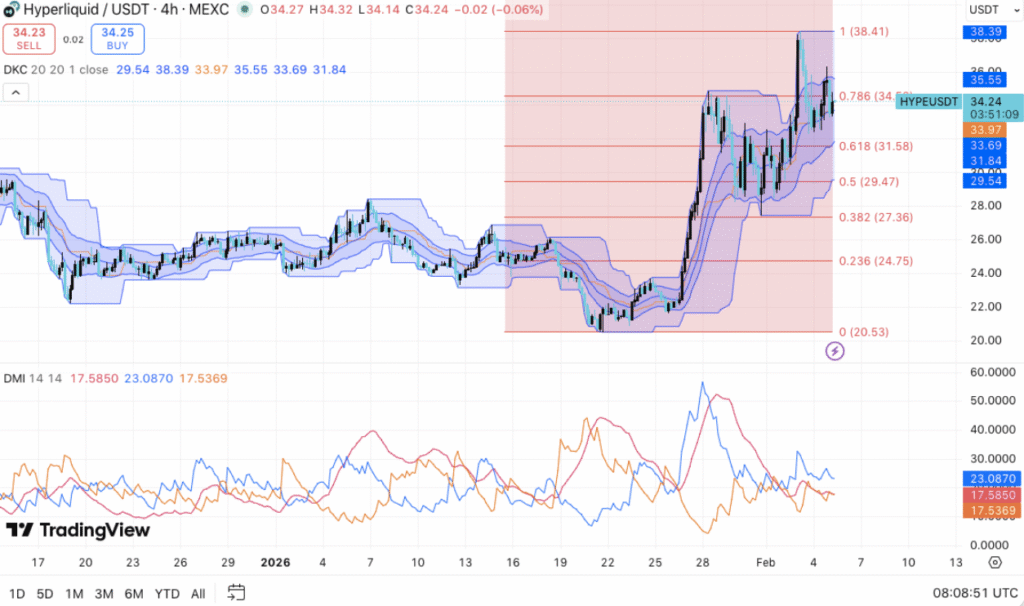

Hyperliquid’s HYPE token has extended its recovery phase, showing strength in short-term technical structure despite moderated momentum. The price advanced from a $20.50 base and is currently consolidating near the 0.786 Fibonacci retracement level, maintaining higher highs and higher lows.

Volatility tools, including Donchian and Keltner bands, widened notably after the breakout. This behavior confirms that the price expansion followed a compression phase, typically considered a constructive signal in trend analysis.

Key Resistance and Support Levels

Current resistance sits between $34.40 and $35.55. Price action near this zone reflects seller activity. A move above this level could trigger an extension toward $38.40. Support rests at $33.70 to $33.90, while a deeper retracement could reach $31.60, which aligns with the 0.618 Fibonacci zone. Structural support holds near $29.40, with trend invalidation closer to $27.30.

Open interest in Hyperliquid contracts has steadily increased after stabilizing between $1.4 billion and $1.6 billion from November to December. Recent data shows a gradual rise toward $1.65 billion, suggesting fresh participation without excessive leverage.

During September and October, open interest had contracted from $2.6 billion as traders reduced risk. However, the latest shift marks a return of cautious bullish sentiment. Despite the uptick, leverage metrics remain subdued compared to previous highs.

Spot Flows Indicate Emerging Accumulation

On-chain spot activity confirms moderation in sell-side pressure. From September to November, distribution dominated, highlighted by multiple outflow spikes. That trend weakened in December, and recent flows suggest light accumulation by market participants.

The shift implies a more balanced market condition, which may support higher prices if participation continues to increase gradually.

Institutional engagement added a new layer to the HYPE narrative. Hyperion DeFi Inc. confirmed it will use its treasury holdings as collateral for options strategies through the Rysk protocol. This initiative aims to generate premium and fee income from HYPE without directional risk.

The firm also plans to combine returns from this strategy with staking yields, eventually opening vaults to other large holders. This move introduces a yield-driven use case for the token, enhancing utility for institutional portfolios.