Key Insights

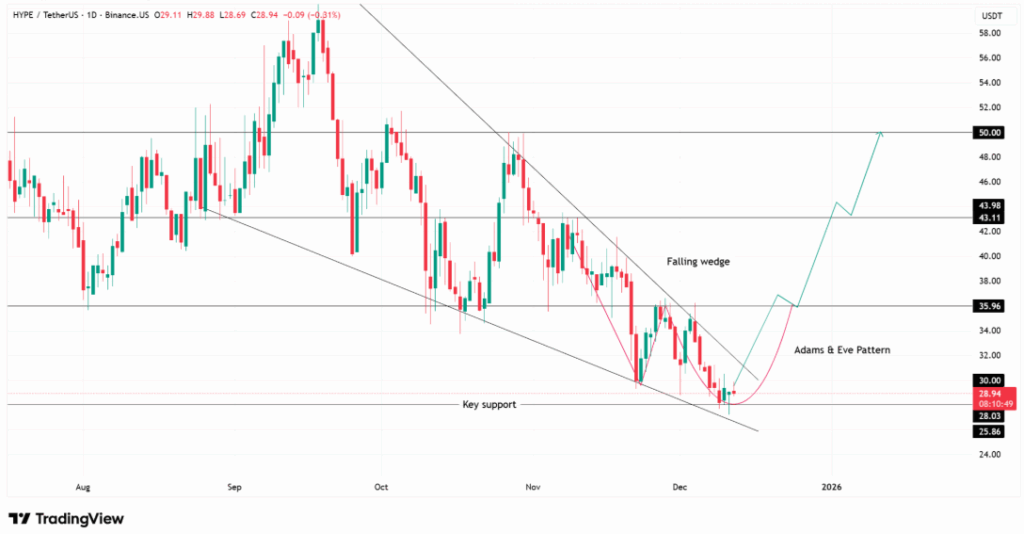

- HYPE price gained over 8% as buyers defended the $28 support zone and formed a rounded base after volatility compression.

- A falling wedge and Adams and Eve structure signal improving control, with higher lows guiding potential moves toward $35.96 and beyond.

- Open Interest climbed to $1.61 billion, confirming stronger participation and supporting continuation attempts as liquidity builds near resistance levels.

HYPE price rose more than 8% over the past 24 hours as trading activity showed clearer direction and improved structure. The token traded near $29 after holding a key support area that shaped recent price behavior. Significantly, buyers defended this zone with steady responses that reduced erratic price swings.

Price action respected the $28 region during repeated tests, and each reaction showed stronger buying interest. Besides offering short-term stability, this area helped the market form a rounded base. Consequently, the broader structure tilted toward recovery after a long phase of volatility compression.

Falling Wedge Defines Reversal Pattern

The chart reflects a well-defined falling wedge that developed after extended selling pressure. HYPE formed higher lows along wedge support, showing improving control by buyers. Moreover, the pattern resembles the right side of an Adam and Eve structure, which often supports gradual trend shifts.

HYPE now trades inside a constructive range where resistance levels guide upside expectations. A move above $35.96 would open space toward $43.11, a level that previously capped advances. Additionally, sustained strength above the midpoint zone leaves room for a move toward the $50 area.

Open Interest Confirms Market Engagement

Open interest increased 7.78% to $1.61 billion, aligning with the recent price recovery. This rise indicates growing participation as the structure improves. Notably, traders added positions while the price moved higher, which supports directional confidence rather than defensive positioning.

Open interest expanded during base formation, which limited forced exits and reduced sharp pullbacks. Moreover, participation increased near wedge resistance, suggesting traders backed continuation instead of fading rallies. This behavior often strengthens breakout attempts as liquidity builds above key thresholds.

HYPE continues to stabilize near $29 as participants maintain exposure within the structure. The alignment between price behavior and open interest supports the current recovery phase. Hence, the market shows room for further movement while buyers retain short-term control.