Key Insights:

- HBAR’s price has dropped more than 50% since August as demand for its ETFs has waned and futures market activity has weakened.

- The Canary HBAR ETF has faced outflows and a lack of investor interest, contributing to the token’s overall downward trend.

- Futures open interest for Hedera has fallen sharply, signaling weakening demand and a potential further price decline.

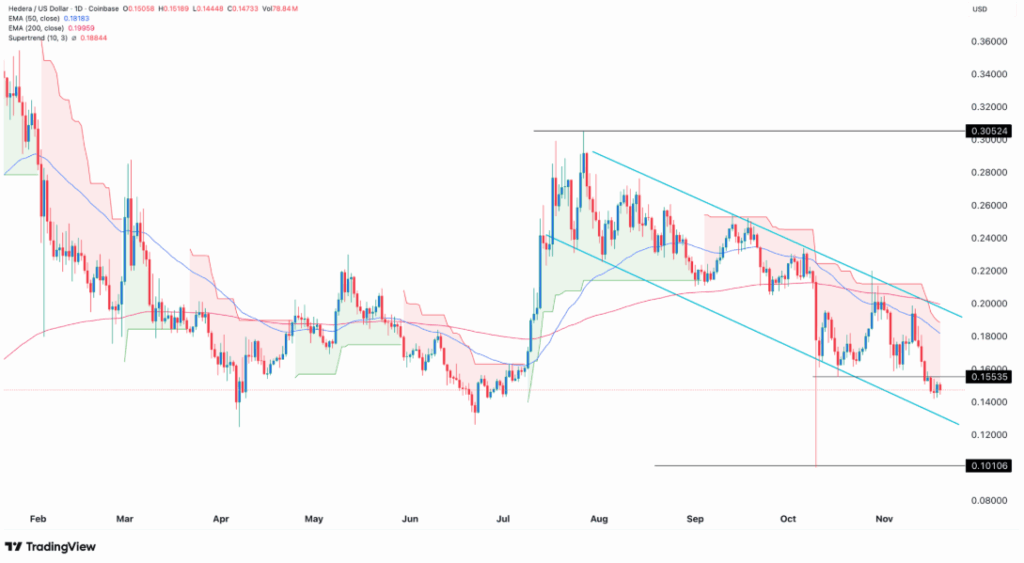

Hedera’s (HBAR) price has been on a steady decline throughout November, continuing a downward trend that began in August. As of November 18, HBAR was trading at $0.1400, marking a more than 52% drop from its peak of $0.3052 in July. This ongoing slump appears to be driven by several factors, including a significant decline in ETF demand and a sharp drop in futures market activity.

One of the key issues facing HBAR is the lack of demand for its Canary HBAR ETF. Data from SoSoValue shows that there have been no inflows into the ETF over the past three trading days. In fact, the ETF saw an outflow of $1.71 million just last Friday. The fund now holds only $74 million in assets, a stark contrast to Solana ETFs, which have accumulated over $420 million in inflows. Investors seem wary of HBAR’s continued downward momentum, especially in light of its recent price performance.

Weakening Futures Market Activity

Another indicator of HBAR’s struggles is the sharp decline in futures open interest. According to CoinGlass, Hedera’s open interest has fallen to $112 million, its lowest level of the year. This marks a significant drop from October, when open interest was $450 million. The decline in futures interest is a direct sign of weakening investor confidence in the token, further exacerbated by the October 10 liquidations that saw over $38 million in HBAR positions wiped out.

The technical outlook for HBAR also paints a grim picture. The price has formed a descending channel since mid-year, indicating a continued downward trajectory. Furthermore, the token invalidated a potential bullish reversal pattern, the double-bottom, around the $0.1553 mark. Adding to the bearish signals, the coin recently formed a death cross pattern, with the 50-day moving average crossing below the 200-day moving average, suggesting that HBAR could face further losses.

The next significant price target for HBAR could be the October low of $0.10, which is roughly 30% lower than its current level. While a move above $0.1600 could change the outlook, it seems unlikely unless there is a drastic shift in investor sentiment or market conditions.