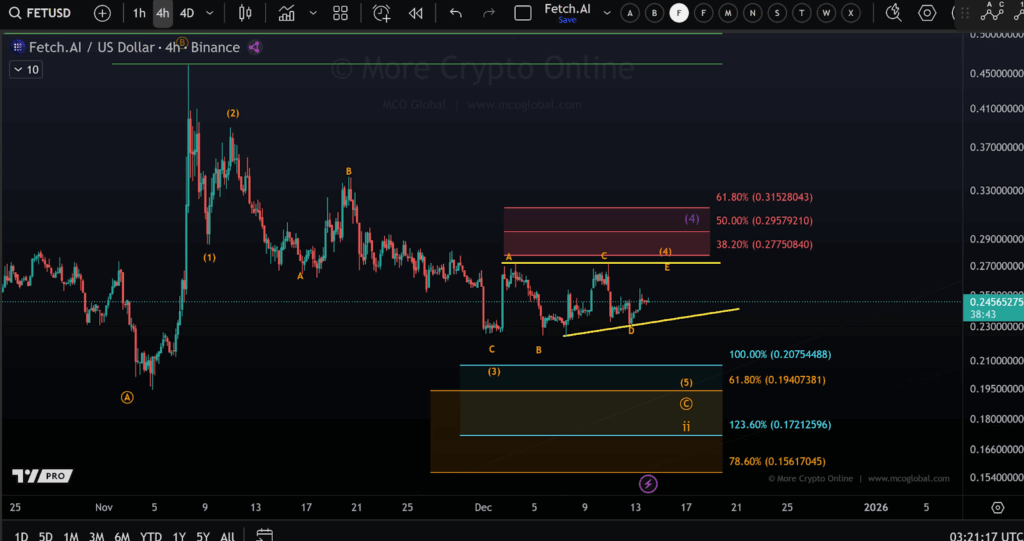

- FET remains within a Wave (4) corrective structure, with overlapping price action signaling continued consolidation conditions.

- A sustained move above $0.272 would indicate a more complex correction rather than immediate bullish continuation.

- Volume behavior remains reactive, confirming participation without validating a new directional trend.

FET remains positioned within a corrective market phase as price action continues to reflect consolidation rather than impulsive expansion. The structure suggests patience among participants rather than urgency. Technical levels are guiding expectations across short-term timeframes. Market behavior continues to favor structure over speculation.

Corrective Environment Shapes Market Behavior

FET entered a slower trading phase following the completion of the prior impulsive advance. Price action since early December has shown persistent overlap and reduced directional clarity. This behavior aligns with corrective market conditions rather than trend continuation. Momentum characteristics continue to support this interpretation.

The decline following Wave (3) established the foundation for the ongoing corrective phase. Subsequent rebounds have lacked impulsive follow-through and structural expansion. Each recovery attempt has remained capped within a defined range. This reinforces the view that the market is correcting rather than trending.

Market commentary has reinforced this broader framework. More Crypto Online noted that Wave (4) remains in progress. The analysis emphasizes patience instead of anticipation. Structure remains the guiding principle for market expectations.

Triangle Structure Defines Wave (4)

Wave (4) is currently tracked as a triangle composed of five internal corrective swings. Price behavior has shown contraction rather than expansion. Momentum has steadily diminished throughout the structure. These characteristics align with a triangle rather than alternative corrective patterns.

Price recently rebounded from the lower boundary of the structure. The advance has pushed into the upper resistance zone without confirmation. Candles remain overlapping and lack impulsive strength. This price behavior keeps the triangle interpretation valid.

Commentary indicated that $0.272 represents the c-wave high. A sustained move above this level would alter the structural outlook. Such a move would suggest a more complex corrective phase. Immediate bullish continuation would remain unlikely under that scenario.

Key Levels and Volume Maintain Focus

Resistance remains unchanged and is defined by Fibonacci retracement levels. The 38.2% and 50% retracements from the prior advance continue to cap price. Sellers have repeatedly defended this zone. Acceptance above this area has yet to occur.

On the downside, structural support is guided by the rising trendline and lower triangle boundary. These levels continue to contain corrective pullbacks. A decisive breakdown would extend the correction toward deeper retracement levels. Such movement would still preserve the broader bullish structure.

FET is as of writing, trading at $0.24, reflecting controlled price behavior. Volume remains elevated compared with earlier phases. Activity appears reactive rather than trend-confirming. Directional conviction remains dependent on structural resolution.