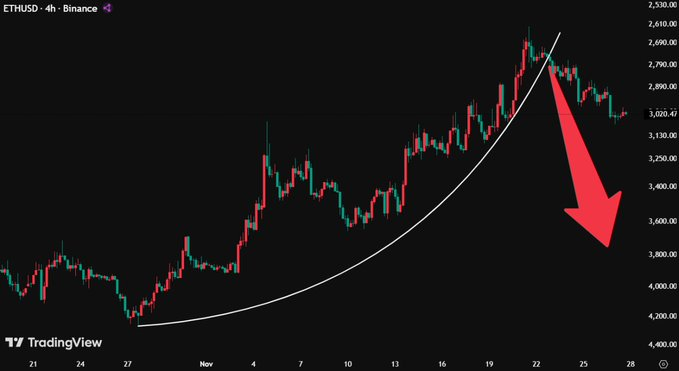

- ETH breaks its rising parabola as market momentum weakens and sellers gain more control.

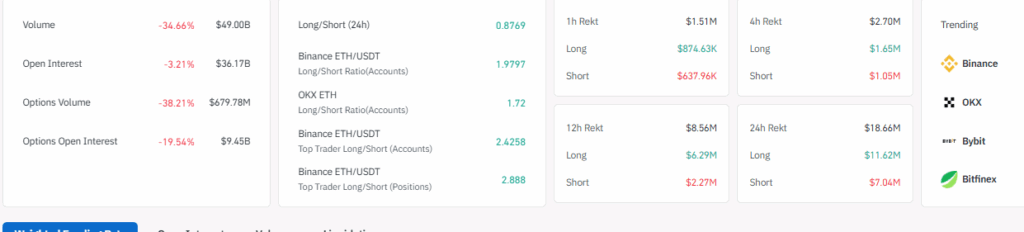

- Derivatives data shows lower activity and rising pressure on leveraged long positions.

- Short-term price action reflects hesitancy with compressed volume and unstable intraday moves.

Ethereum trades through a period of fading momentum, with its short-term trend structure weakening. Market data shows reduced activity across derivatives while price movement remains choppy, forming a landscape shaped by caution and shifting sentiment.

Parabolic Structure Breaks and Market Tone Shifts

Ethereum’s recent advance formed a steep parabolic curve through late October and mid-November. That structure carried price higher with tightening pullbacks and stronger recoveries. The pattern signaled an aggressive phase fueled by rising momentum.

Analyst Cas Abbé shared a chart noting that ETH “has lost its parabola,” marking the point where the curve failed. The price rolled over after reaching the upper $2,900 area and could not return to the former trajectory. The transition represented a structural shift rather than a simple pullback.

The chart showed ETH producing lower highs after losing curvature support. That movement created space below the parabola, suggesting stalled velocity. Abbé added that “the dump has started,” reflecting how breaks of this type often precede sharper downside phases.

Derivatives Data Shows Cooling Participation

Broader derivatives metrics support the view of slowing activity. Total volume fell more than 34 percent, with open interest also down. Options markets showed reduced participation, with volume and open interest declining at steep rates. These conditions reflect shrinking speculative appetite.

Exchange long-short ratios presented a mild long bias on major platforms. However, the tilt was not strong enough to shift the broader trend. The presence of long bias during a weakening price phase often signals exposure rather than strength.

Liquidation data added more context. The 24-hour window showed substantial long liquidations, reaching above $11 million. Those figures aligned with a market where long positions were pressured during downward moves. Sellers found more opportunity as leveraged positions unwound.

Short-Term Price Action Reflects Caution

ETH as of writing, traded near $3,017 in the latest session. Intraday movement showed repeated swings between the $2,995 and $3,035 zones. Recoveries lacked follow-through, while dips tested psychological levels without strong support. The balance showed uncertainty rather than trend continuation.

Volume fell more than 31 percent, reaching $14.91 billion. Lower participation during a drift phase often suggests hesitation among traders. Market cap remained at $364.2 billion, showing muted reaction despite volatility. News flow added a layer of sentiment. A report involving Paris Hilton’s crypto portfolio hinted at cooling interest across celebrity-driven narratives. Such stories reflect a softer retail environment, matching the broader slowdown visible across charts and metrics.