- ETH funding steadies after a sharp October washout, suggesting a market preparing for its next major shift.

- Russell 2000 sits at a long-term barrier that may determine the next advance in Ethereum and altcoins.

- Ethereum’s recent breakout aligns with network upgrades that increased the block gas limit to 60M.

Ethereum market conditions show renewed activity as key risk assets approach crucial levels. Traders observe technical signals across multiple charts, including equities, derivatives, and spot markets, to assess the next directional move.

Risk Index Approaches a Critical Barrier

The Russell 2000 chart shows the index pressing into a multi-year band of resistance. This area has stopped every prior advance since early 2021. Its current position places global risk appetite at a key turning point.

Cas Abbé noted that the Russell 2000 often gives early signals for Ethereum and altcoins. When the index reaches a new all-time high, alternative assets typically follow. Its present test of resistance forms a pivotal reference for crypto traders.

Price action shows a sharp ascent into this barrier rather than a slow return. This fast climb suggests a stronger momentum profile. The index now requires a clean breakout to open the next expansion phase for high-beta markets such as ETH and altcoins.

Funding Data Shows a Shift in Trader Positioning

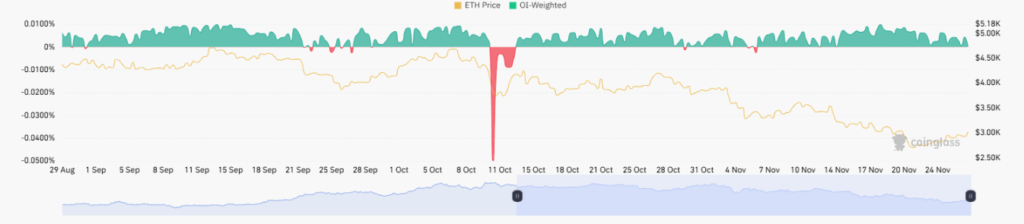

The ETH OI-Weighted Funding Rate chart displays varied trader behavior from late August to late November. Funding held above neutral early in the period, showing moderate long-side conviction. During those weeks, ETH traded above $4,300 before momentum weakened.

A sharp move on October 11 recorded the deepest negative funding reading in the dataset. This event aligned with broad liquidation pressure. Funding reached nearly –0.05%, reducing leverage across major platforms. It marked a decisive moment for derivatives positioning.

As November progressed, funding moved back toward neutral levels. Traders reduced aggressive exposure while ETH drifted into the mid-$3,000s. Reduced leverage often sets the stage for stronger movement once market conditions shift and liquidity builds.

Spot Market Reacts to Network Expansion

Ethereum as of writing traded near $3,030.05 with a 24-hour gain of 3.02%. The move followed a long stretch of intraday consolidation. Price remained below $2,950 earlier in the session before breaking higher.

A key catalyst arrived with the recent block gas limit increase from 30M-60M as reported by analyst DavidTheBuilder. The upgrade expanded network capacity. Market participants responded quickly as the change signaled further scaling potential.

A near participation of $22.06B with a slight decline per day. The circulating supply is at about 120.69M ETH and the market cap is approximately at 365.71B. Such metrics contextualize the recent price change as a repricing that is essential because of the progress in network throughput.