- Ethereum trades inside a rising corrective channel after a sharp sell-off, maintaining compression rather than signaling renewed upside momentum.

- Trading volume peaked near recent highs, pointing to distribution behavior before a pullback and reduced market participation.

- A breakdown below channel support aligns with a measured move projection that places the $2,400 region in focus.

Ethereum remains in a consolidation phase after a rapid repricing event reshaped short-term market structure. Price compression, declining participation, and defined technical boundaries now guide near-term expectations across the broader market.

Bear Flag Structure Keeps Downside in Focus

Ethereum price action transitioned into a rising channel following a decisive impulsive decline. This structure aligns with a classical bear flag, reflecting corrective movement rather than sustained trend recovery.

The preceding sell-off formed a clear flagpole that defines proportional downside risk levels.

Price continues trading beneath former breakdown zones, reinforcing the absence of structural trend reversal signals.

A recent post from @alicharts noted that sustained compression often resolves in the dominant direction. That perspective reflects continued respect for channel symmetry and persistent supply near the upper boundary.

Volume Patterns Signal Participation Cooling

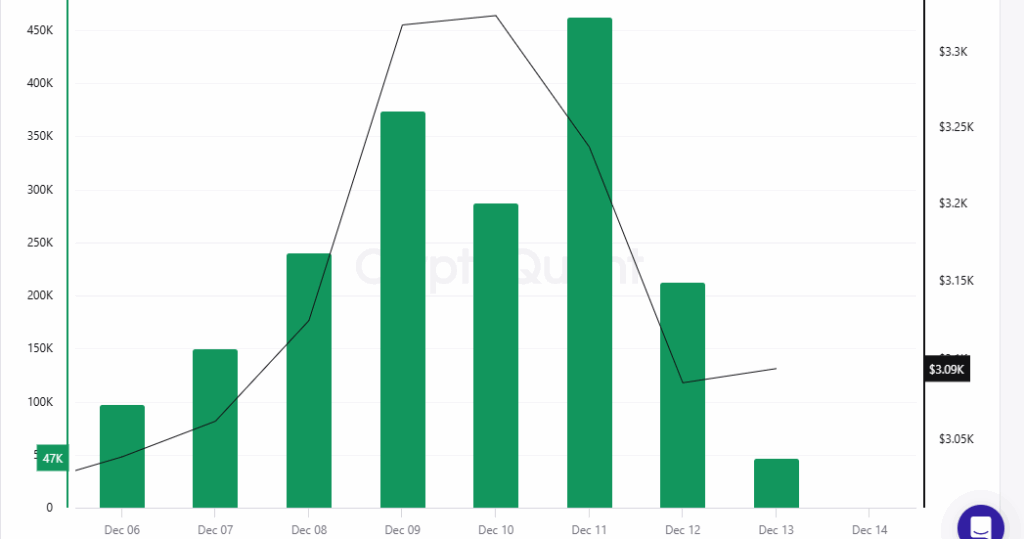

Ethereum advanced from above $3,000 toward the $3,300 area as volume expanded steadily through December 9. Rising participation confirmed directional conviction during the advance, supporting the initial upside momentum phase.

As price stabilized near highs, volume peaked sharply, signaling heavy two-way trade activity. Such conditions often reflect absorption, where late buyers meet systematic selling pressure.

Ethereum later pulled back toward $3,100 as volume tapered noticeably.

By December 13, price stabilized near $3,090 while participation dropped, signaling indecision and reassessment.

NFT Market Adds Broader Context

NFT markets pegged to Ethereum indicate widespread short-term pressure on large collections in this consolidation phase. Prices fell on the floor over several periods which portrays a reserved placement rather than general forced selling.

The presence of collections like Bored Ape Yacht Club and Pudgy Penguins kept the number of transactions consistent.That action indicates continued price discovery as members fine-tune exposure in the process of consolidation.

High-value collections showed price stability driven by limited turnover rather than renewed demand. This selective liquidity environment aligns with broader recalibration as Ethereum trades within defined technical limits.