- Broadening wedge within a downtrend reflects expanding volatility and seller control at higher levels.

- Rejection from the prior descending channel reinforces resistance and limits upside follow-through.

- Consolidation near key support persists as volume contracts, delaying directional confirmation.

Ethereum presents a measured snapshot of market balance amid recent volatility, reflecting cautious participation across timeframes. Short-term stability contrasts with broader structural signals that continue guiding professional risk assessment. Traders remain attentive to confirmation rather than anticipation.

Broadening Wedge Defines the Dominant Structure

The ETH/USD chart is an indication of a widening wedge, commonly referred to as a megaphone, within an already set downward trend. The trend in this building is high and low patterns that are increasing, indicating a lack of agreement between the buyers and sellers. Volatility growth within a declining context often aligns with distribution rather than accumulation.

A recent attempt to reenter the prior descending channel failed near overhead resistance. That channel previously guided prices lower for months, shaping market behavior. Rejections from former trend channels frequently reinforce prevailing momentum. This rejection preserved the broader bearish framework.

Analyst Colin Talks Crypto emphasized these bearish qualities through structural interpretation. The tweet framed the pattern as continuation rather than reversal. That perspective aligns with historical behavior following similar formations. Structure continues to outweigh short-term fluctuations.

Consolidation Masks Underlying Instability

On lower timeframes, Ethereum trades within a narrow intraday range following recent swings. Price hovered near $3,118, moving between defined support and resistance zones. Buyers defended the $3,100 area, preventing immediate breakdowns. Sellers remained active near $3,130, limiting upside progress.

The intraday price trends reflect prompt responses on both the market sides. Temporary rallies did not have the follow through and pullbacks generated the responsive buying. This action is an indication of positioning due to liquidity rather than conviction. Consolidation therefore reflects digestion of earlier volatility.

Trading volume declined during this sideways movement, reducing breakout probability. Cooling participation often accompanies range-bound conditions. Without expanding volume, directional moves tend to stall. The market continues rotating within established boundaries.

Market Metrics and Comparative Context

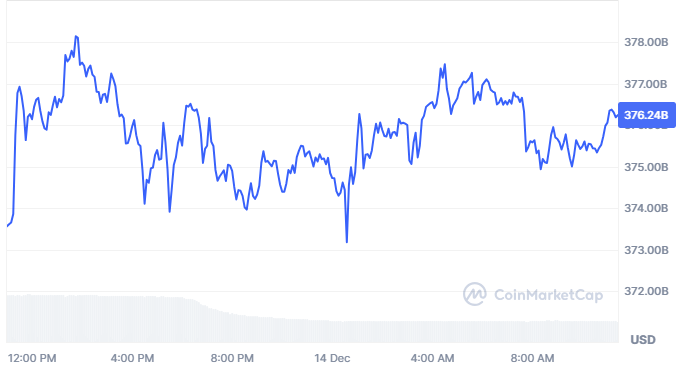

Ethereum’s market capitalization remained near $376 billion, closely aligned with fully diluted valuation. Supply metrics stayed stable, removing uncertainty from circulating dynamics. Liquidity absorbed intraday volatility without sharp dislocations. These conditions support orderly consolidation.

The volume-to-market-cap ratio remained moderate, indicating participation without urgency. Such readings often appear during pauses inside larger trends. Directional resolution typically follows renewed activity. Until then, price remains technically constrained. Comparative analysis noted by VinCoop pointed to similarities with prior consolidation phases. The commentary referenced historical cycles following extended ranges. Data attribution from CoinMarketCap supports the metrics discussed. Market participants continue monitoring structure for confirmation.