- WIF consolidates between $0.70–$1.30, forming a base as traders await a breakout confirmation.

- Open interest decreases 3.47% as the trading activity increases 11.58% indicating cautious positioning.

- Key resistance zones lie between $3.32–$4.26, with a bullish target range extending toward $5.00.

Dogwifhat (WIF) is experiencing a phase of prolonged consolidation, drawing close attention from traders as market activity intensifies and resistance levels approach.

Consolidation Zone and Market Structure

The WIF/USDT daily chart shows an extended sideways movement since March 2025, following a steep decline from early-year highs. Price has oscillated between $0.70 and $1.30, establishing a key range with repeated tests of both ends. At present, WIF trades around $0.77, reflecting a 1.37% daily gain while staying near its lower consolidation band.

A green support zone between $0.70–$0.80 has provided a strong accumulation base, absorbing selling pressure and stabilizing price action. Shah Faisal Shah (@vnzabbar) expressed confidence in this structure, stating, “I’m selling my house because ATH is inevitable,” signaling high conviction among some market participants. The chart forecasts high upside potential to $4.00-5.00 above this.

Notable levels of resistance are at $3.32, $3.47 and $4.03 and a significant ceiling of $4.26. An escape beyond these levels would signify a new wave of bullishness. The inability to protect the present support can lead to a collapse below the pink risk zone, holding off the prospects of returning to all-time highs.

Derivatives Activity and Trader Positioning

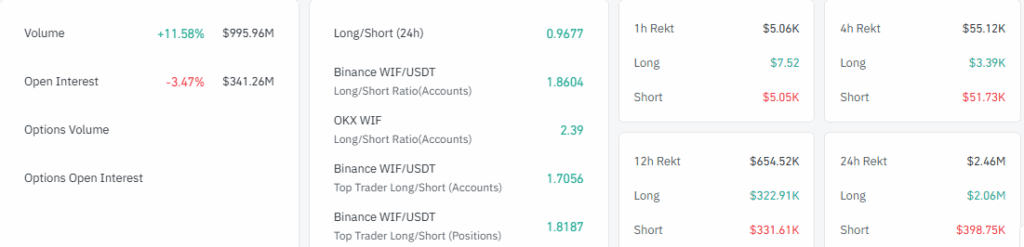

The derivatives market reflects a mixed sentiment toward WIF. Trading volume has increased by 11.58%, reaching $995.96 million, indicating growing participation. However, open interest declined by 3.47% to $341.26 million, suggesting existing positions are being closed rather than expanded.

Long/short ratios reveal cautious optimism across platforms. Binance WIF/USDT reports a 1.8604 ratio (accounts), while OKX WIF shows a more aggressive bullish stance with 2.39. Top traders on Binance maintain ratios above 1.70, suggesting a leaning toward long positions despite broader market hesitation.

Liquidation data adds to this picture. Over the past 24 hours, long liquidations dominated at $2.06 million, while shorts accounted for $398.75K. A 12-hour snapshot shows gains for long positions at $322.91K, while shorts lost $331.61K, indicating temporary shifts in momentum.

Key Levels and Forward Outlook

The direct attention is still on the support band of $0.70 to $0.80 and the breakout point of $1.30. Inability to trade below these levels would provide an avenue to further resistance at $3.32 to $4.26. A clean breakout could drive WIF into the projected green zone above $5.00.

Short-term data shows active scalp and swing trading, with notable short-side losses during brief upward moves. Over the past four hours, $51.73K in shorts were liquidated compared to $3.39K in longs, reflecting shifting intraday momentum.Community sentiment remains optimistic, with traders like The Penguin ThePenguinXBT suggesting that WIF “looks ready for the next leg.” While this aligns with growing derivatives activity, the market continues to balance between emerging bullish interest and the risk of near-term volatility.