- Dogecoin structure remains bullish with higher lows, suggesting accumulation and a potential move toward $0.6533.

- Top traders on major exchanges hold strong long positions, contrasting with neutral retail sentiment.

- Rising open interest and short liquidations point to underlying bullish pressure despite falling trading volume.

Dogecoin continues to show structural strength as higher lows define its price action, while derivatives metrics reveal cautious retail sentiment contrasted by strong long positioning among top traders. The setup as of writing points to a potential breakout toward $0.6533.

Structural Uptrend Points Toward Key Target

JAVONMARKS, a market analyst, noted that Dogecoin has maintained a clear uptrend, forming consistent higher lows since the major correction from its 2021 peak. This pattern indicates further accumulation and purchasing strength even after periods of price retracement.

The price action broke out of the long downtrend during 2023 and 2024, marking a series of higher highs and higher lows. These structural changes suggest a market positioning for continuation, especially in meme-driven assets that attract speculative demand.

This means a breakout level should be technically around $0.6533, which is a nearly 3x move from current levels. Fibonacci extension levels and the uphill trendline pattern support this view, with a longer-term level around $1.27 still in play if momentum continues to gain traction.

Derivatives Data Shows Mixed Sentiment

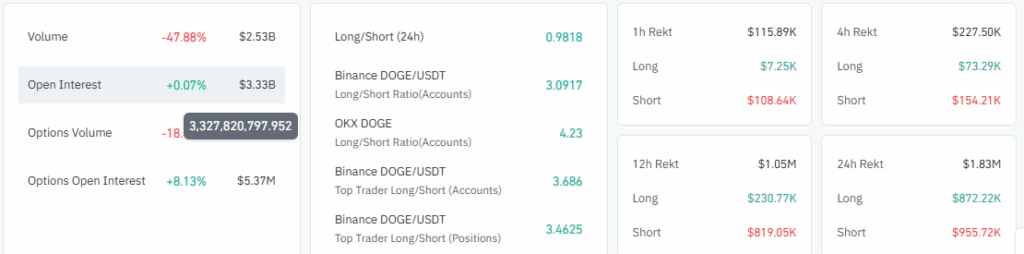

Dogecoin derivatives data reflect cautious behavior among retail participants, with trading volume falling by 47.88% to $2.53 billion. Open interest, however, remains steady at $3.33 billion, up by 0.07%, indicating that positions are being held rather than closed.

In the options market, open interest increased by 8.13% to $5.37 million while volume declined by 18.42%. This translates to traders looking ahead to future volatility but not actively trading futures contracts at this time, which signals a strategic setup phase.

The 24-hour long/short ratio is 0.9818 indicating that retail traders are near-neutral. Conversely, Binance and OKX ratios are higher than 3.0, reflecting strong long positioning by larger and more sophisticated traders.

Liquidation Trends Favor Bullish Bias

Liquidation data reveal that short positions are taking heavier losses across all timeframes, with $955,720 liquidated over the past 24 hours versus $872,220 for longs. This pattern indicates that upward price movements have repeatedly forced bearish traders to exit positions.

On shorter horizons, such as one-hour and four-hour windows, shorts continue to face greater liquidation pressure. This shows that upward spikes in price are triggering quick short squeezes in thin liquidity conditions.

With top traders holding strong long positions and retail traders remaining cautious, market structure suggests a potential move higher. If the ascending support holds, Dogecoin may test psychological checkpoints at $0.10, $0.25, and $0.50 before approaching the $0.6533 target.