- Dogecoin is trading within a $0.208–$0.242 channel, with bulls preparing for a decisive resistance test.

- Binance long/short ratio at 2.72 and top trader ratio at 3.75 show heavy bullish positioning.

- DOGE has gained 150% over the past year despite a -23.83% year-to-date decline.

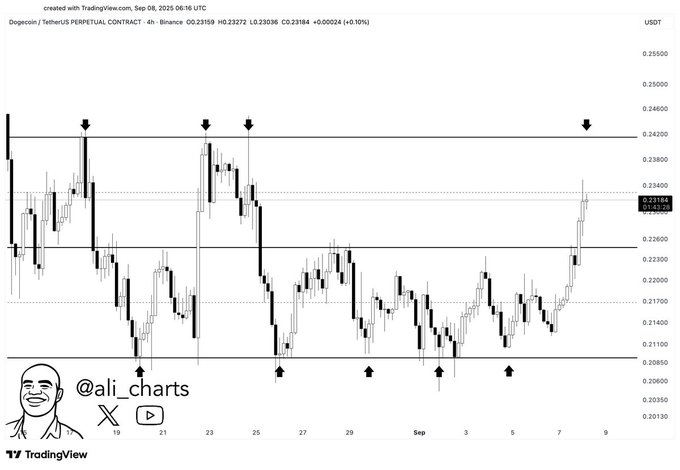

Dogecoin is approaching a decisive moment as price action targets the upper boundary of its trading channel. With bulls showing renewed momentum, the $0.242 resistance zone has become the focal point for traders anticipating the next breakout move.

Dogecoin Approaches Channel Resistance

Dogecoin ($DOGE) is pressing toward the upper boundary of its trading channel, as chart data points to a key resistance retest. Ali (@ali_charts) shared that price action remains confined between $0.208 support and $0.242 resistance, with buyers repeatedly defending the lower floor.

The lower boundary at $0.208 has acted as a strong accumulation zone. Market participants have consistently entered at this level, signaling buyer conviction whenever price dips into the range. These repeated defenses reinforce the structural base that has guided short-term positioning.

Conversely, the $0.242 level remains a ceiling where sellers previously forced reversals. Each advance toward this line has been met with resistance pressure, leaving traders closely watching for a confirmed breakout. The breakout point would represent a structural shift in momentum if buyers can sustain strength.

Market Momentum and Price Action

As of writing, Dogecoin trades near $0.241 after spiking to $0.24364 on September 9, 2025. Intraday volatility has been high, but bulls held key levels above $0.238 after mid-session pullbacks. This resilience signals strengthening momentum ahead of another attempt at channel resistance.

Recent performance metrics support the bullish bias. DOGE has gained 1.73% in the last 4 hours, 3.34% in 24 hours, and 14.37% across the week. Over 90 and 180 days, the coin is up 21.27% and 39.49%, respectively. Yearly growth stands out at 150.27%, although the year-to-date figure remains negative at -23.83%.

Trading volumes confirm market activity, with 24-hour volume recorded at $3.76 billion. This activity reflects increasing trader participation as Dogecoin nears the $0.242 breakout line, a level that has historically dictated continuation or reversal phases.

Sentiment and Trader Positioning

Market sentiment is leaning bullish, reinforced by long/short positioning across major exchanges. On Binance, the DOGE/USDT long/short ratio stands at 2.7258, while top trader accounts report a stronger ratio of 3.7551. Similar ratios at OKX further validate broader optimism.

These figures suggest aggressive positioning from traders who expect sustained upside momentum. However, the elevated ratios also raise caution, as heavily skewed positioning can trigger liquidations if price fails to advance.

Ali’s analysis places the next target firmly at $0.242, where market participants are monitoring both volume and candle formations. A decisive move above this level could drive further momentum, potentially expanding Dogecoin’s trading range beyond the channel.