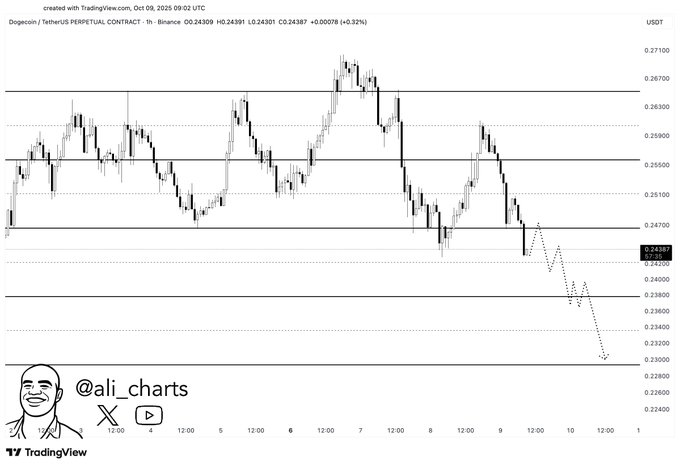

- Dogecoin is still building lower highs after being rejected around $0.27 and it has a short-term bearish structure.

- The $0.247–$0.249 support range has flipped to resistance, confirming downside continuation toward $0.23.

- Liquidity is firm and there is caution in the trading volume with temporary relief rallies.

Dogecoin continues to exhibit structural weakness after multiple failed recovery attempts. The market’s current setup points to a controlled decline, with traders now watching the $0.23 area as the next potential support zone in play.

Weak Market Structure Confirms Downtrend Continuation

Dogecoin ($DOGE) remains under steady selling pressure as its technical framework weakens further. The asset has consistently printed lower highs and lower lows since facing rejection near the $0.27 level, forming a clean short-term downtrend.

Analyst Ali (@ali_charts) stated that “Dogecoin wants to revisit $0.23,” emphasizing the coin’s deteriorating structure. He noted that the break below the $0.247–$0.249 range — once a strong demand zone — confirmed bearish control. That area has now turned into resistance after an unsuccessful retest, signaling that buyers have lost key ground.

This trend is not new to Dogecoin in the period of correction. Every slight recovery has been lower than the last, indicating a decrease in the bullish power. The dots on the chart indicate likely stalls at about $0.243, $0.239, and $0.233 then it might stabilize around about 0.23. This stepwise decline is a calculated market correction, not the panic liquidation.

Price Action Reflects Systemic Bearish Bias.

Dogecoin trades at around $0.2521, with a positive growth of 0.95% per day, yet the small recovery indicates underlying structural vulnerability. CoinMarketCap shows that the market capitalization of the asset is 38.14 billion, and the trading volume for the day is 3.23 billion, which indicates active but cautious engagement.

The coin was lower at a point of $0.2456 on October 9, 2025, but it has since slightly bounced off above the $0.25 line. Even with this increase, recurrent rejections at approximately $0.253-$0.255 suggest that selling happens. The price structure once again is sell side and recovery seems to be more corrective than directional, which is typical of short-term relief rallies seen during previous declines.The pivotal point of the $0.25 level is technical and psychological.

Sustained movement below this level reinforces the bearish trajectory outlined by Ali. Traders are now monitoring how DOGE behaves between $0.24 and $0.245 — a zone that could define whether the market stabilizes or extends toward $0.23.

Market Sentiment Cautious as $0.23 Zone Draws Attention

Broader market sentiment around Dogecoin remains cautious. Analyst Genny Cruz described the chart as “looking weak again,” capturing the mood of traders balancing between temporary optimism and broader structural decline.

Volume growth of about 6% over the last day indicates activity, but not conviction. The rise is probably a result of short-term speculation and not build-up by long-term holders. This aligns with price action that has shown reactive trading behavior near key intraday levels without firm trend confirmation.

If the projected move toward $0.23 materializes, that level may attract liquidity as it has historically served as a demand pocket. However, failure to hold there could open a path toward $0.22, deepening the retracement. Until DOGE reclaims $0.25–$0.26 with clear momentum, bearish sentiment remains intact and rallies are expected to fade quickly.