Key Insights:

- Chainlink’s price has dropped 53% since September, erasing billions in value despite major bullish catalysts.

- Grayscale’s upcoming LINK ETF launch is expected to drive demand, but Chainlink continues to face a prolonged bearish trend.

- Falling exchange reserves and increased strategic reserves signal rising demand for Chainlink, but bearish technical patterns suggest more downside risk.

Chainlink’s price has remained under significant pressure throughout the month, continuing its downward trend despite several promising developments. The token recently dropped to $13, a substantial decline of approximately 53% from its peak in September. This sharp decrease has wiped out billions of dollars in market value, leaving many investors concerned about its future price trajectory.

One of the main catalysts for optimism surrounding Chainlink has been the upcoming launch of Grayscale’s LINK ETF, which is set to debut next week. As a key utility token in the crypto ecosystem, the ETF could drive considerable demand from investors, potentially boosting the token’s value. Despite this, Chainlink has failed to see the expected price surge, with the market continuing its bearish stance.

Chainlink is not the only cryptocurrency to experience ETF success. Solana’s ETFs, for example, have attracted over $618 million in inflows and are nearing $1 billion in assets. Similarly, XRP ETFs have seen a surge in investor interest, with more than $666 million in inflows. These strong performances highlight the growing demand for utility tokens but have yet to offer any relief for Chainlink.

Falling Exchange Reserves Indicate Rising Demand

In a potentially positive sign for Chainlink, the supply of LINK tokens on exchanges has continued to plummet. According to data from Nansen, the supply of LINK on exchanges has fallen sharply from 275 million to just 214 million, signaling increased demand. The shrinking exchange reserves suggest that investors are moving their tokens off exchanges, perhaps in anticipation of long-term growth.

This decline in exchange reserves coincides with the addition of more tokens to Chainlink’s strategic reserves. These reserves are now approaching 1 million LINK tokens, a development that could further tighten available supply and drive future demand.

Bearish Technical Indicators Weigh on Chainlink

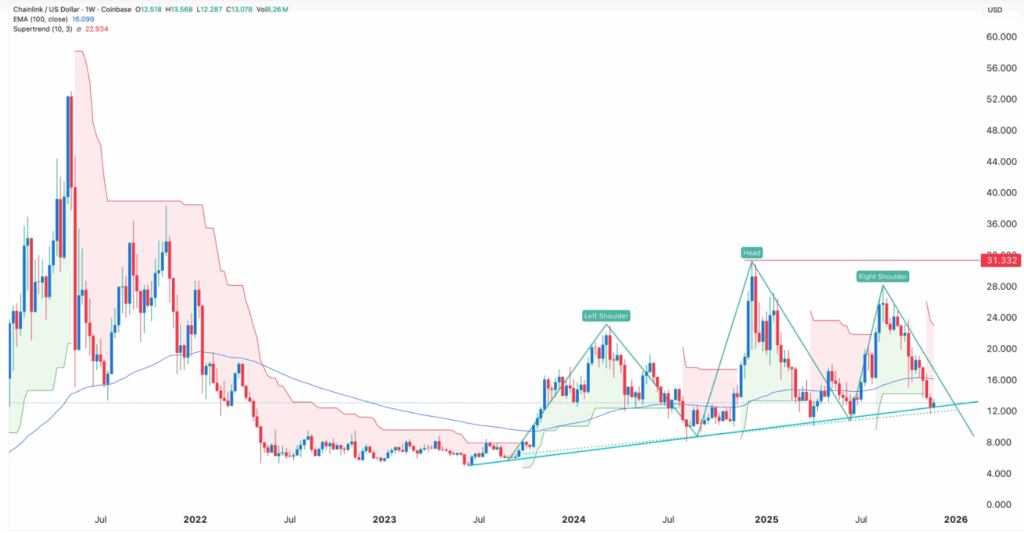

From a technical analysis perspective, Chainlink’s price chart reveals concerning signs for investors. The weekly chart shows that the token has formed a head-and-shoulders pattern, a classic bearish reversal signal. LINK has also dropped below the 100-week Exponential Moving Average (EMA) and the Supertrend indicator, both of which are crucial technical levels.

Currently, LINK is testing the neckline of the head-and-shoulders pattern, with the next potential support level sitting at $10, marking a 22% decline from its current price. A move below this support could push the token further down, possibly reaching the 2023 low of $8. Given these bearish technical indicators, the outlook for Chainlink in the near term appears grim.