Key Insights

- Chainlink’s strong rebound from the $16 demand zone highlights consistent buying interest and renewed confidence among investors.

- Exchange outflows worth $16.57 million indicate tightening supply, strengthening the potential for continued upward momentum.

- Whales holding over 54 million LINK reinforce the support base, aligning with the bullish breakout setup toward $27.

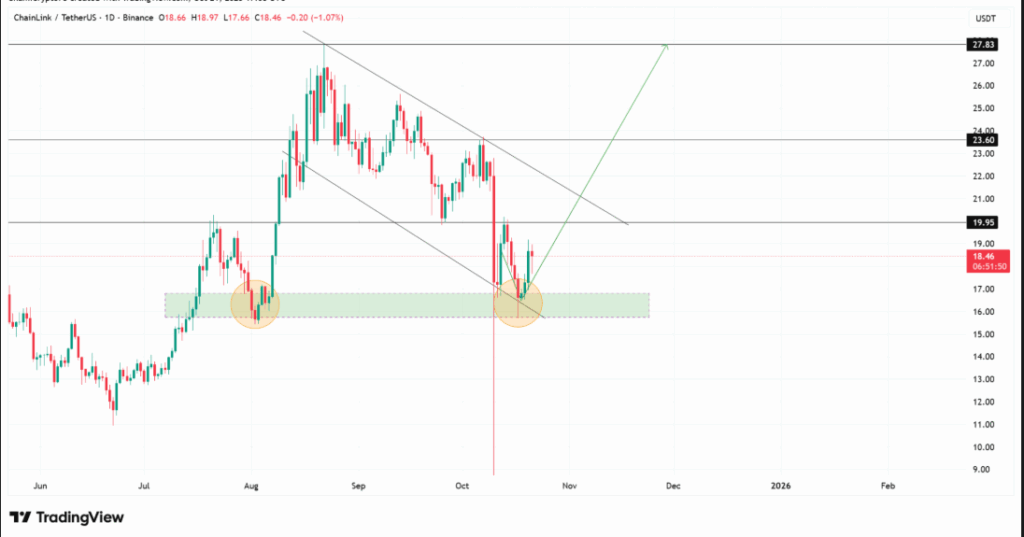

Chainlink’s price rebounded strongly from the $16 demand zone, a level that has repeatedly triggered major recoveries. This area has become a key support range as investors continue to view it as a value-buying opportunity. The price structure has remained within a descending channel, where the lower boundary consistently attracts buyers, showing a sustained level of market confidence.

The recent price movement now faces resistance near $19.95, a level that has historically dictated the strength of previous rallies. Each time LINK surpassed this barrier, momentum accelerated rapidly. The daily chart indicates that the current pattern could again lead to a sharp move if the resistance breaks. Additionally, analysts have identified a tightening symmetrical triangle formation that has developed since 2022, signaling a potential breakout phase in the coming weeks.

Technical Indicators Suggest Path Toward $27

A confirmed breakout above $19.95 may pave the way for a retest of $23.6. Continued momentum could push LINK toward $27 before December. The formation of higher lows over recent sessions supports this upward outlook. The long-term structure remains constructive, with consistent accumulation signaling growing conviction among large investors.

On-chain data shows that whales have accumulated about 54.47 million LINK around the $16 range. This accumulation has strengthened the area as one of the most resilient support zones. Historical patterns reveal that such activity has often preceded strong price reversals, emphasizing sustained confidence in Chainlink’s long-term potential.

Exchange Outflows Confirm Reduced Supply Pressure

Exchange data from CoinGlass recorded $16.57 million in net outflows on October 21, marking one of the largest single-day withdrawals in recent weeks. This decline in available exchange supply typically signals tightening liquidity, which often precedes upward price pressure. Together, the whale accumulation and exchange outflows highlight a synchronized bullish trend, reinforcing expectations of continued strength in Chainlink’s price structure.