Key Insights:

- Chainlink’s price has risen 4% recently, with analysts targeting $20 based on technical trends.

- Grayscale’s LINK Spot ETF acquisition of 2 million tokens boosts market confidence in Chainlink.

- Chainlink’s RSI and MACD indicators point to continued bullish momentum, signaling potential gains.

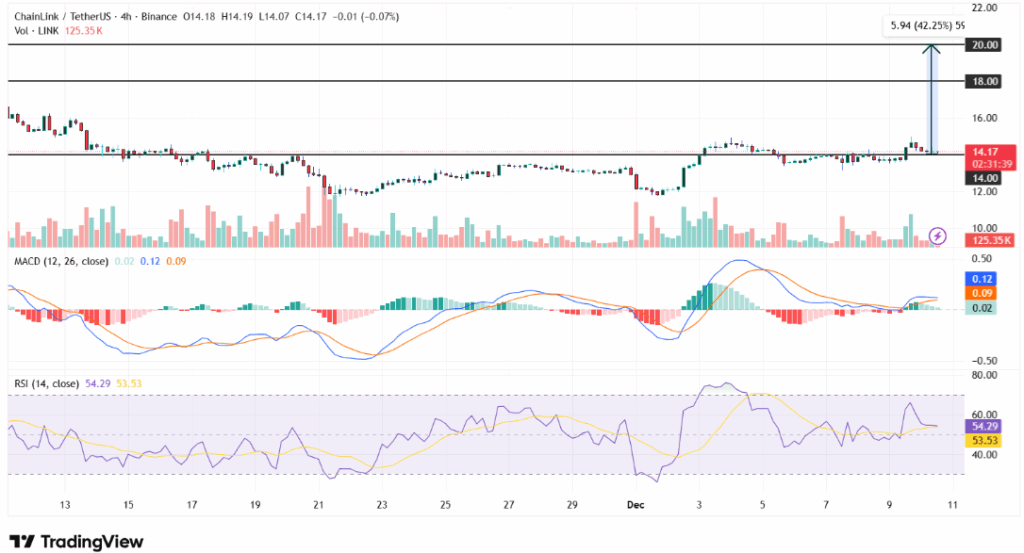

Chainlink’s (LINK) price has shown strong potential to surge toward the $20 mark in the coming weeks. Trading at $14.11 as of Wednesday, December 10, 2025, the cryptocurrency has demonstrated an encouraging upward trend. Recent price movements have been marked by higher lows, signaling strong foundations for future growth. With market indicators leaning toward bullish behavior, Chainlink is poised to reach new heights.

Grayscale LINK ETF Adds Confidence to Chainlink’s Growth

One of the key factors contributing to Chainlink’s bullish outlook is the positive market sentiment surrounding its recent developments. Grayscale’s LINK Spot ETF has made significant waves, acquiring 2 million LINK tokens in a single week. This move has amplified investor confidence, further strengthening the case for Chainlink’s potential surge. This development, alongside the general market optimism, especially in the wake of Bitcoin’s strong performance, creates a promising outlook for LINK’s price growth.

From a technical analysis perspective, the outlook remains positive for Chainlink. The Moving Average Convergence Divergence (MACD) indicator has entered positive territory, signaling strong momentum. Similarly, the Relative Strength Index (RSI) remains above the 50 mark, suggesting that the market remains in a favorable position for further gains. These indicators point to a possible breakthrough at the $18 resistance level, paving the way for further upside toward $20.

The potential $20 target represents a 42% increase from the current price, aligning with the optimism around the Grayscale ETF’s acquisition and the broader cryptocurrency market’s performance. However, this upward trajectory is not without risks. A shift in market sentiment or unexpected resistance could hinder progress, with a support level identified around $12.00, which could trigger a downward correction.

Broader Crypto Market Sees Optimistic Momentum

Beyond Chainlink, the broader cryptocurrency market has shown significant growth, further boosting the sentiment for LINK. Bitcoin’s price remains strong, hovering above $92,000 as the FOMC meeting approaches. Ethereum’s price has surged by 5% in the past 24 hours, while other notable cryptocurrencies like Solana, XRP, and Dogecoin have also seen positive movements. This optimism has spilled over into LINK, enhancing expectations for continued growth.

Chainlink’s price momentum has made it one of the most-watched assets in the market. If the positive technical signals persist and the broader market continues its upward trajectory, Chainlink could soon see itself at $20. With growing interest from institutional investors and strong technical support, the outlook for LINK remains bullish as we close in on December 2025.