- Chainlink’s TVS surged to $66 billion, supporting its strong position in the DeFi space.

- LINK price has strong technical support, with analysts predicting a bullish rebound.

- Chainlink’s growing network fees and LINK Reserves reflect positive momentum for the coin.

Chainlink’s price has recently pulled back by 20% from its year-to-date high, entering a phase of bearish sentiment. However, analysts remain optimistic about the future of the cryptocurrency, as strong technical indicators and a growing network suggest a possible rebound. With its Total Value Secured (TVS) hitting a new all-time high, Chainlink’s prospects look promising for the remainder of the year.

Chainlink has seen remarkable growth this year, with its TVS in decentralized finance (DeFi) reaching a record $66 billion. This significant increase, from $25 billion in April, highlights the growing importance of the Chainlink network. A number of major blockchain players, including Maple Finance, Compound, and Fluid Lending, are contributing to this surge. Consequently, the network has seen a steady increase in fees, reaching over $431,000 in September alone, further solidifying its strong position in the DeFi ecosystem.

LINK Reserves and Potential ETF Approval

An additional factor supporting Chainlink’s price is the growth in LINK Reserves, which have jumped to over $8.3 million. This development signals a growing commitment to the network’s success. Moreover, the potential approval of exchange-traded funds (ETFs) could further benefit the LINK price. While the SEC has yet to make a final decision, the launch of new listing standards suggests that approval could be on the horizon, providing another bullish catalyst for the cryptocurrency.

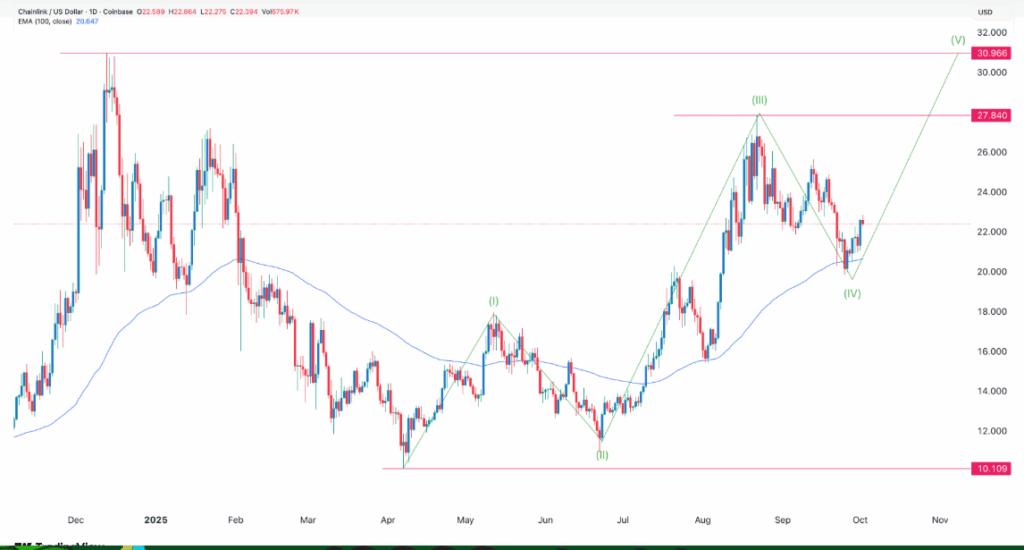

From a technical perspective, Chainlink’s price is currently in the fourth phase of the Elliot Wave pattern, a typically bearish stage. Despite this, the coin’s performance is supported by the 100-day Exponential Moving Average (EMA), and analysts are forecasting a potential bullish fifth wave. The next target for LINK’s price is the year-to-date high of $27.85, with a further surge possible if it surpasses this level. A move past $30 could open the door for more significant gains.