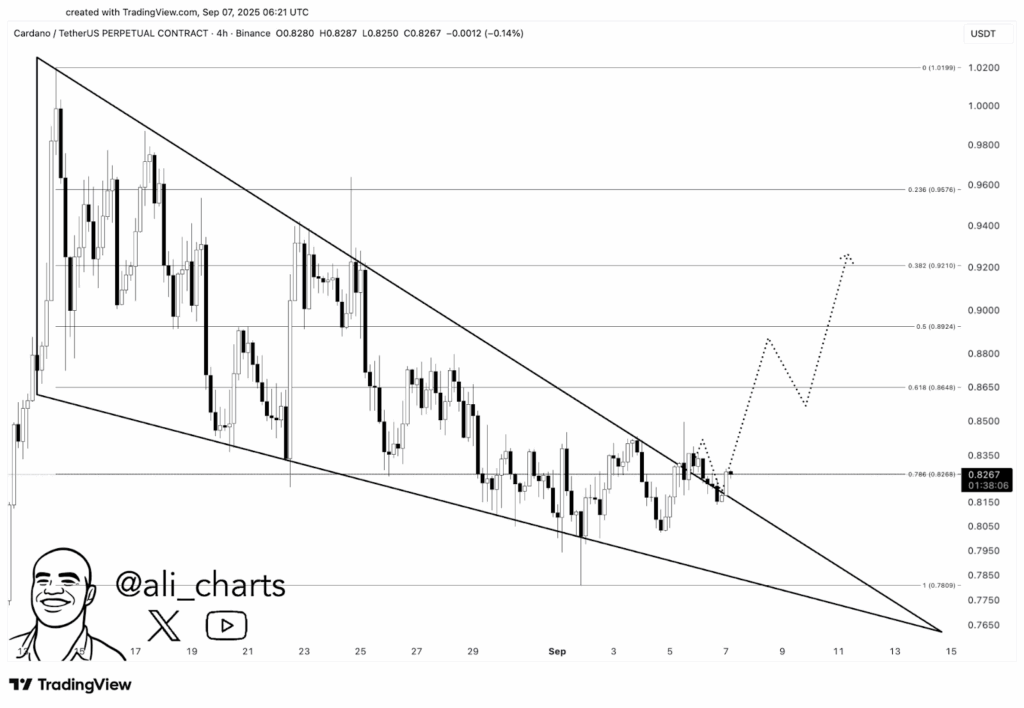

- Cardano (ADA) must surpass $0.84 to confirm a breakout from its descending wedge formation on the 4-hour chart.

- Failure of support at $0.81 may result in tests of $0.79 and 0.76 which will keep bears in action.

- Market events like rate cuts and ETF approval could accelerate ADA’s move beyond $1.25 in September.

ADA is trading in a falling wedge with the analysts identifying the resistance level of 0.84 as the critical point. Break is possible above this level and this will open more targets and support at $0.81 is essential to prevent the pressure at the downside.

Technical Breakout Setup

Cardano (ADA) has been consolidating within a descending wedge pattern on the 4-hour timeframe, a structure widely regarded as a potential reversal formation. This wedge developed through lower highs and narrowing price action from mid-August into early September.

Ali (ali_charts) noted that ADA should surpass $0.84 to verify a breakout. This resistance corresponds to the upper limit of the wedge and it acts as the pivot point in the direction of the future direction in the near term. Any decisive action beyond this point has the potential to turn the tide against the buyers.

In the event of confirmation, ADA can rise to $0.88, $0.90, and $ 0.92. These targets are based on Fibonacci retracement levels that have been calculated using the latest swing high to low, which increases their technical weight. Traders, though, will be wary of volume indicators, as poor participation may lead to false breakouts.

Support Levels and Downside Risks

In the short term, $0.81 remains an important support level. A rejection at resistance could bring ADA back to this zone for a retest. Such a move would not invalidate the wedge formation but may delay an upside continuation.

Should ADA lose this support, the next levels to monitor are $0.79 and $0.76. These zones represent prior liquidity clusters and the wedge’s lower boundary. Breaks below these levels would challenge the bullish setup and reinforce selling pressure.

Analysts expect ADA’s path higher to form in stages. Resistance at $0.88 could initially halt gains, followed by corrections before further continuation. This gradual “stair-step” progression is consistent with how recoveries usually unfold in volatile markets.

Macro Events and Broader Outlook

There is more than technical analysis at play in the future course of ADA; other macroeconomic forces can be decisive. Sssebi backed the Ali story by indicating that potential decreases of rates on September 17 could create the push to reach gains. Historically, such events improve sentiment in risk assets, including digital currencies.

In that scenario, ADA could challenge $1.25 resistance and possibly close the month above $1.50. Additional drivers, such as an exchange-traded fund approval, may further support higher valuations across the crypto sector.

The above projection indicates that ADA can hit the target of $3 within the next three months in good conditions. Even as the short-term traders focus on the breakout of the $0.84, the long-term players consider the possibility of increasing their returns as the policy shifts and regulatory approvals can drive up the gains.