Key Insights:

- Coinbase’s roadmap listing of BNB boosted its price near $1,200, highlighting growing market confidence in the token’s long-term liquidity.

- Changpeng Zhao welcomed Coinbase’s decision, describing it as a logical step given BNB’s solid market position and ecosystem growth.

- Technical data shows neutral momentum as BNB consolidates near its 30-day average, with traders awaiting new catalysts for direction.

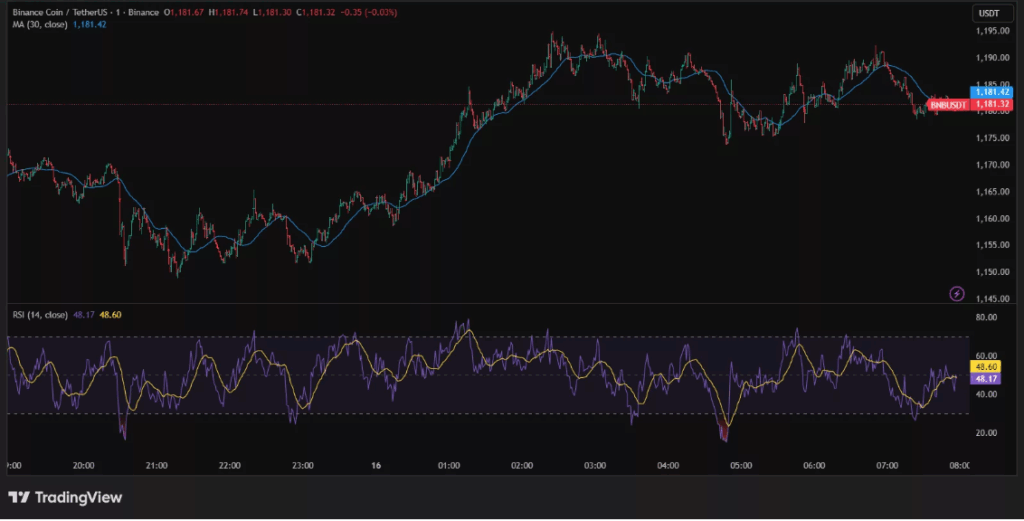

BNB surged to as much as $1,191 following Coinbase’s announcement of adding the token to its listing roadmap. The price later stabilized near $1,181 after brief volatility. The decision marks Coinbase’s first move to include BNB, eight years after its launch as Binance’s exchange token.

Former Binance CEO Changpeng Zhao responded to the news, expressing support for Coinbase’s listing decision. Zhao described the move as a “no-brainer,” noting BNB’s strong liquidity and market presence. His post, which included messages of support from crypto figures such as TRON founder Justin Sun and the Kraken exchange, contributed to a modest 0.5% intraday price gain for BNB.

BNB’s Market Position and Liquidity Strength

BNB maintains a market capitalization of around $164.9 billion, making it the third-largest cryptocurrency after Bitcoin and Ethereum, excluding the stablecoin Tether. Zhao emphasized that exchanges benefit from listing highly liquid assets, stating that omitting BNB would be a missed opportunity. He also encouraged BNB developers to “keep building,” reinforcing the token’s long-term ecosystem growth.

BNB’s price has been hovering around its 30-day moving average, indicating a consolidation phase following earlier upward movement. The Relative Strength Index stands near 48, signaling neutral momentum with limited buying or selling pressure. This suggests that traders are waiting for additional catalysts related to the Coinbase listing or broader market shifts before committing to a direction.

Market Awaits Next Catalyst

Analysts note that a renewed wave of optimism surrounding the Coinbase listing could help BNB retest resistance levels between $1,190 and $1,200. However, a move below $1,175 may indicate temporary weakness if overall crypto sentiment turns cautious. Despite the mixed reactions, the announcement has reinforced BNB’s position as a dominant market asset with substantial global liquidity.