- $TAO climbs 36% in a day, restoring market confidence after a mass liquidation dip.

- Trading volume surpasses $560 million, reflecting renewed liquidity inflow and active buying pressure.

- Price structure remains intact as $TAO consolidates above $410, supported by Fibonacci and Elliott Wave alignment.

Bittensor ($TAO) has recovered impressively following a recent liquidation shock, reclaiming technical structure and investor confidence as its trading volume more than doubles, signaling a potential continuation of the asset’s broader bullish phase.

$TAO Recovers Structure After Liquidation Shock

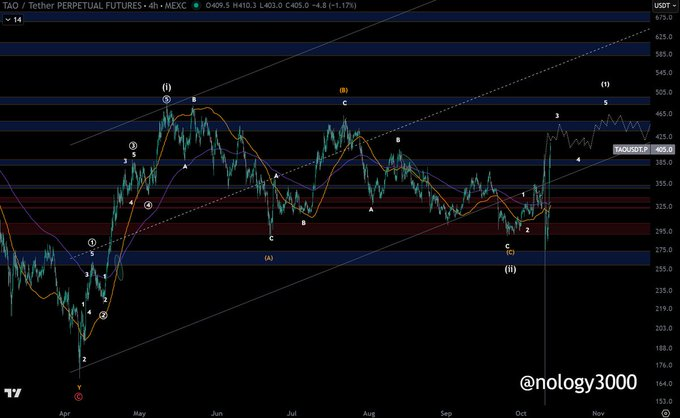

Bittensor ($TAO) has mounted a sharp rebound after a mass liquidation event, reaffirming its resilience within a broader Elliott Wave framework. The chart shared by analyst Nology (@nology3000) illustrates how Fibonacci levels remain central in guiding price direction. Despite a deep wick during the liquidation drop, the analyst maintained that the wave count structure stayed valid, viewing the move as a temporary “black swan” deviation rather than a true invalidation.

Following the event, $TAO reclaimed the $325 support zone, initiating a strong upward reaction that restored market momentum. The turnaround has been marked by a hasty run to $405-410 which indicates that traders have returned and are now technically confident. This trend implies that the market still admires the Fibonacci retracement and extension zones, which implies that there is a controlled growth as opposed to a chaotic price movement.

The broader wave configuration shows that $TAO completed an (A)-(B)-(C) correction from mid-August through early October, marking the end of its prior pullback. The subsequent recovery restored confidence in bullish spirit and reasserted the rising channel of price movement of the asset based on April lows. The wick of the liquidation momentarily missed the bottom margin of that channel and the price has gone back sharply up, reassuring the fact that the structure preservation is not compromised.

Volume Surge Reflects Renewed Liquidity Inflow

Market data shows that $TAO’s trading activity has intensified rapidly.According to CoinMarketCap, the volume has increased by 110% in 24-hour volume to $566 million with the market capitalization hitting $4.25 billion. An increase in the Volume to Markets Cap ratio, which currently stands at 13.42%, indicates a busy trading and high liquidity turnover, which is likely to be followed by prolonged bullish movements.

The intraday moves are representative of a decisive parabolic formation beginning at 307, as the price rises with the help of TAO through significant levels of resistance at $350 and $390 before reaching $422 levels. The halt at about $399-$405 formed a healthy consolidation area and this indicates that the market is taking off profit making effectively. Such controlled price action suggests that the rally is not due to short-term speculation, but structural demand.

Social sentiment also reinforced the momentum shift. Traders like Mr. James commented that “$TAO just pulled off a monster rally — up nearly +30% and still climbing.” Such remarks reflect a growing sense of confidence among participants who now view $TAO’s recovery as a confirmation of trend strength.

Technical Structure Points to Sustained Upside Potential

Analyst Nology’s interpretation of $TAO’s Elliott Wave alignment suggests the asset is currently in the early phase of a new impulsive sequence. The price action above $410–$420 may transform this zone into a structural base for the next wave leg, targeting the $450–$475 area if momentum persists.

Short-term oscillation between $385 and $425 remains possible as the market consolidates recent gains. However, the higher low formations and a crossover between short- and mid-term moving averages indicate steady bullish control. Each corrective dip continues to attract renewed buying interest, confirming that participants remain protective of lower boundaries.At the time of writing, Bittensor ($TAO) is at a price of $420.79 which is a 35.92% daily gain and a 32.93% weekly gain. The technical structure is positive so long as the price of $TAO does not fall below the ranges of the $360-380 area, as it is backed by the Fibonacci and structural integrity. The recovery has re-established the power of market discipline structure – a reminder that, even following volatility shocks, technical consistency usually tends to dominate.