Key Insights:

- BNB’s all-time high surge is supported by strategic alliances, including a partnership with Franklin Templeton.

- Technical patterns suggest BNB’s price could reach up to $1,500 in the coming weeks.

- Institutional backing, including CEA Industries’ $368 million purchase, strengthens BNB’s growth prospects.

The Binance coin (BNB) has jumped massively to an all-time high of over $904 after the institutions provided it with strong support. This is a rally following the strategic alliance between Binance and Franklin Templeton, a well-known asset management company with assets under management of 1.6 trillion. This partnership has added institutional assurance to the Binance ecosystem, which is helping the coin to rise in its growth path.

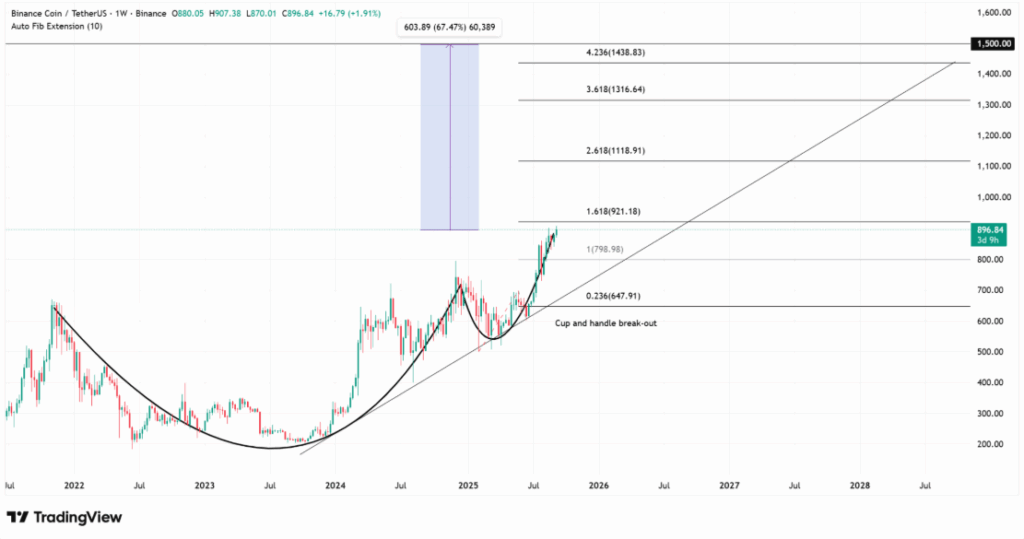

The price chart of BNB is now taking a positive bullish trend after breaking out of a cup-and-handle formation. This coin is currently consolidating at around $896, and the immediate resistance is at 921. A sustained breakout over this would take the price to $1,118, $1,316, and ultimately to $1,438.

The market analysis even indicates that the price of 1500 is affordable, which again supports the positive picture. But a breakdown in the support zone of $798 might lead to the price contracting back to the level of $647, where demand might resume once more.

The Institutional Support of Long-term Perspective.

The collaboration with Franklin Templeton enhances the position of BNB as a blockchain-based asset, especially in regulated markets. The alliance is an indication of increased embrace of blockchain technology in conventional finance. Also, the investment of CEA Industries in BNB of $368 million further constrains the supply, further increasing the growth potential of BNB. The presence of this institutional support forms a ground wherein further bullish activity is implied that would lessen the likelihood of bullish market dynamics.

The price of Binance Coin is also highly supported by an increase in demand and good technical structures. The coin has proceeded to print more and more high-lows, which reflects a strong market. Besides, its partnership with Franklin Templeton also demonstrates the move towards stronger connections of Binance to conventional financial models. This tactical action might result in long-term stability and expansion of BNB, in particular, with the increase in institutional participation. The future of BNB is good as the market continues to react positively.