Key Insights:

- Avalanche’s price has dropped 72%, significantly impacting its market capitalization and investor sentiment.

- The Granite upgrade promises improvements in cross-chain functionality and transaction speeds, but market conditions remain challenging.

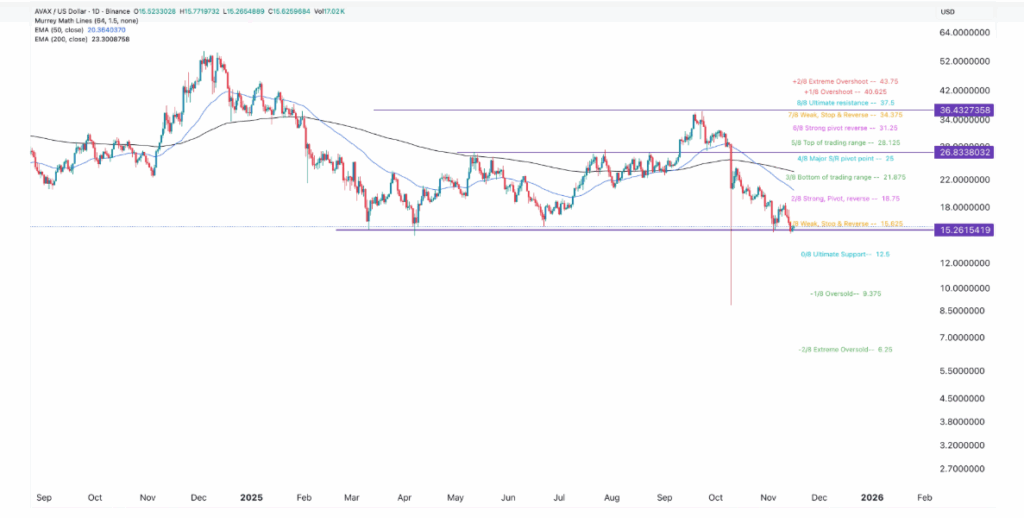

- AVAX faces a critical test at the $15.26 support level; failure to hold may lead to further declines to $12.50.

Avalanche (AVAX) has fallen sharply, losing 72% of its value from its peak in November. The token is currently trading at $15.67, a crucial support level that has held firm since March. This decline has significantly impacted its market capitalization, which has dropped from $13 billion to $6.7 billion. As traders await the network’s Granite upgrade, AVAX’s immediate future remains uncertain, with the potential for further downside if this key support fails to hold.

This week, the Avalanche network is set to activate its highly anticipated Granite upgrade. Having undergone testing on the Fuji testnet in recent months, Granite promises significant improvements to the platform. Among the key features of the upgrade are enhanced cross-chain messaging, biometric authentication support, and dynamic block times aimed at speeding up transactions. While these upgrades are expected to boost the network’s functionality, it remains to be seen how they will impact AVAX’s price in the short term.

Market Conditions Weighing on Avalanche

Despite the excitement surrounding the Granite upgrade, Avalanche is not immune to broader market trends. Recent data reveals a decline in stablecoin supply and a drop in decentralized exchange (DEX) volume within the network. Over the last seven days, stablecoin supply has decreased by 2.52%, while DEX volume has fallen from a monthly high of $407 million to $108 million.

Additionally, the total value locked (TVL) in Avalanche has dropped from $3.51 billion to $2.05 billion. These developments highlight the challenges the network faces as it tries to maintain momentum.

Technical Indicators Point to Possible Downside

From a technical perspective, AVAX is showing concerning signs. The price has plunged from a high of $36 in October, settling at its crucial support level of $15.26. Technical analysis indicates a possible continuation of the downward trend if the support fails to hold. The formation of a death cross, with the 50-day and 200-day moving averages crossing over, further supports the bearish outlook. If AVAX loses its current support, it could test the next major support level at $12.50. However, a rebound could see a retest of the $25 pivot point.