- AVAX remains below former support with derivatives data showing cautious positioning from leveraged traders.

- Open interest rises while price falls, indicating speculative activity instead of renewed accumulation.

- Funding stays near zero with long liquidations increasing, suggesting sustained downside risk for AVAX.

Avalanche AVAX trades under renewed pressure as its price structure weakens and derivatives metrics show limited interest from buyers. Market data reflects fading confidence while traders monitor how the asset reacts to nearby resistance.

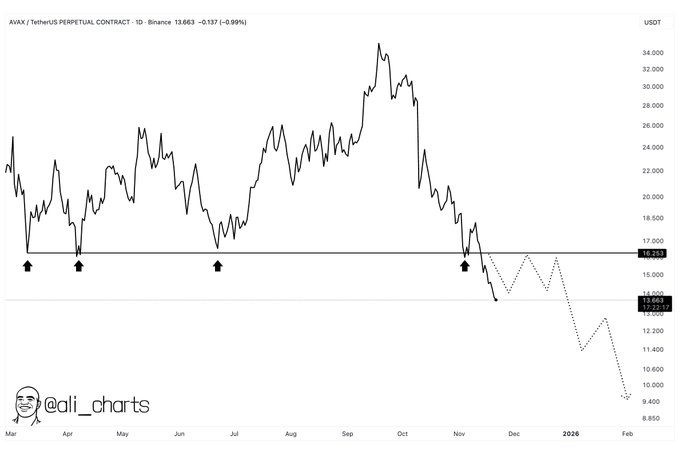

AVAX Breaks Below Key Support

Avalanche AVAX dropped beneath the long-held $16 support level after a steady decline across recent weeks. The level had served as a major floor through several tests earlier this year. Its loss now shifts the structure toward a clear bearish trend.

A well-known analyst Ali (@ali_charts) shared a chart noting that AVAX has moved under this range after repeated failures to form higher lows. The analysis suggested that the failed retest confirms the $16 area as a new resistance zone. The projection also outlined a potential short-term bounce toward this level before renewed selling pressure.

With price as of writing trading around $13.27, the asset sits inside a range with limited historical demand. The next visible support sits near the $9 to $10 region, forming the next logical target unless buyers regain control.

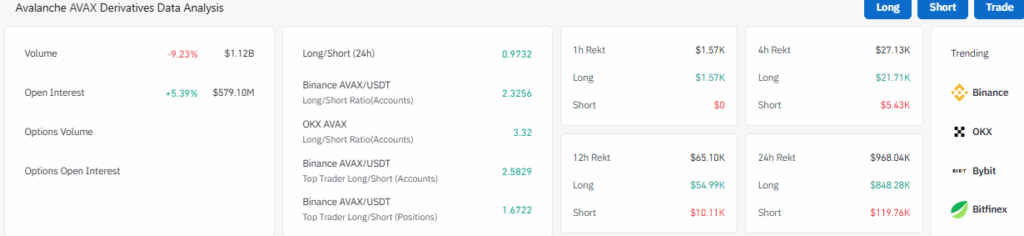

Derivatives Data Reflects Growing Caution

Derivatives indicators reinforce the weakening structure as funding metrics continue to hover near or below zero. This trend shows reluctance from long traders to pay a premium during a declining market. It also points to persistent pressure from short positions and cautious positioning from hedged traders.

A sharp funding dip in mid-October marked a moment of intense selling activity. Funding later stabilized but stayed muted, showing that bullish conviction remains limited even after the spike in volatility. This pattern suggests traders continue to position defensively.

Open interest increased by more than five percent while AVAX declined across the same window. Rising open interest during a price downturn commonly reflects added speculative exposure rather than accumulation, leaving room for more volatility.

Liquidations and Trader Positioning Add Pressure

Liquidation data shows most forced losses coming from long positions. Over the last sessions, both 12-hour and 24-hour readings revealed a notable imbalance favoring long liquidations. This aligns with a market grinding downward and triggering stop-outs on leveraged longs.

Long-to-short ratios across exchanges also reveal a divide between retail traders and larger accounts. Retail remains slightly long-skewed, while professional traders appear more restrained. This separation often occurs during extended corrective phases.

With price action weak, derivatives traders show no strong signals of capitulation or accumulation. Until funding turns positive with rising price and open interest declines, the broader outlook for Avalanche AVAX remains cautious.