Key Insights

- Aster DEX will burn 50% of all buyback tokens while locking the rest for future airdrops to limit circulation.

- Aster’s price dropped below $1 despite the buyback announcement, reflecting short-term market hesitation among investors.

- The burn aims to enhance token scarcity and long-term value, but traders remain cautious amid ongoing market volatility.

Aster price dropped by 2.8% on Friday, falling below the $1 threshold after the Aster DEX team revealed plans to burn half of its buyback tokens. The move marks the project’s first major token reduction initiative since the start of its buyback program earlier this month.

Aster DEX confirmed it would permanently destroy 50% of the tokens acquired through its Season 2 and Season 3 buybacks. The remaining half will be locked for future airdrops, effectively removing the tokens from circulation. The project stated that the burn process would take place directly on its public buyback address, which currently holds over $10.6 million in digital assets.

Price Reaction and Market Sentiment

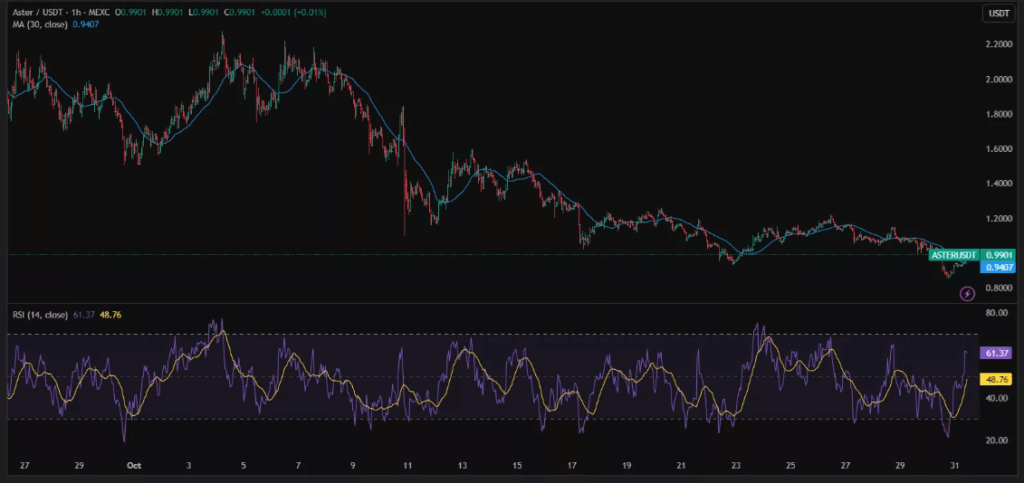

Following the announcement, Aster’s value slipped to $0.98 from its previous $1 mark, despite expectations that the reduced supply could strengthen long-term value. Traders appeared cautious, waiting for clear signs that the new mechanism would drive sustained growth. The token has now fallen nearly 59% from its early October high of $2.41.

According to recent market data, Aster’s 30-period moving average is positioned near $0.94, forming a short-term resistance zone. The Relative Strength Index climbed to around 61, suggesting modest buying activity following the burn announcement. However, momentum remains fragile as broader market confidence continues to waver.

Project’s Strategy and Community Update

Earlier this month, Aster allocated up to 80% of its Season 3 fees for token buybacks to stabilize value during uncertain market conditions. The team emphasized that the mechanism would evolve to ensure sustainable growth and transparency.

Aster DEX reiterated its focus on refining the buyback and airdrop framework, signaling ongoing adjustments to its tokenomics. While the burn is expected to reduce supply, investors continue to monitor whether these changes can restore upward momentum for the ASTER token.