- Aster approaches major support as price stays capped below $1 and $1.10.

- Funding remains long-tilted despite a persistent downtrend in recent sessions.

- Market structure shows compression, raising risks if local support fails.

Aster is trading near a fragile technical area as the market continues to weaken. The recent pullback has created a tightened structure, with traders monitoring whether the current support zone can withstand growing pressure from persistent selling.

Technical Structure Near Key Levels

Aster as of writing, trades at $0.9801 after a 24-hour decline of 2.11 percent. The market shows a steady contraction within a descending pattern marked by lower highs. This structure narrows toward a local support area near $0.97–$0.98, which has absorbed several tests.

Repeated pressure on this shelf has reduced reaction strength. Each retest attracts fewer buyers, indicating thinning participation. If sellers push below this area, the chart may open space toward deeper liquidity levels that remain untested.

Ardi’s recent update noted that $1 and $1.10 remain essential thresholds. These levels shaped previous recoveries and served as turning points. Until they are reclaimed, the broader setup continues to favor bears.

Funding Data Shows Long-Leaned Positioning

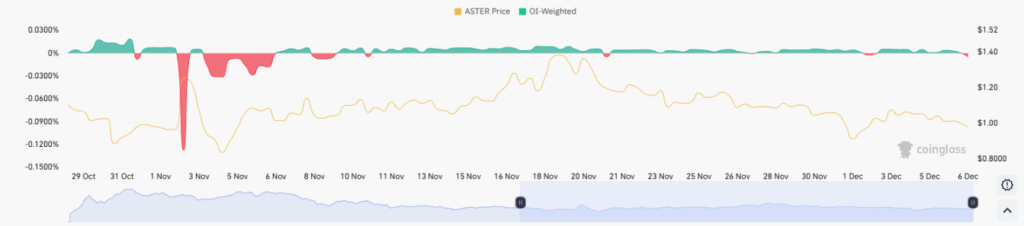

Funding behavior has remained steady through much of November and early December. OI-weighted funding stayed near zero or slightly positive despite ongoing downside pressure. This disconnect signals long exposure remained intact even during broad weakness.

The early-November dip was the lone moment of aggressive long capitulation. Funding moved deeply negative during a sharp retrace. Yet funding recovered quickly and moved back to neutral as the pullback continued. This showed shorts did not seize control of positioning.

Since mid-November, price has trended lower from the $1.40 region while funding held steady. That pattern points to a market leaning long while failing to generate upward movement. This alignment often precedes sharp adjustments when major supports fall.

Market at a Critical Juncture

Aster has shown a slow-bleed motion through recent sessions. Neutral funding, compressed volatility, and persistent lower highs form a structure that demands resolution. Current conditions show a market awaiting a catalyst at a narrow inflection point.

Attempts at upward expansion stalled beneath the $1.07–$1.12 momentum cap. This ceiling rejected each relief attempt and preserved the descending pattern. A break above that zone would change trend character, but the structure remains intact for now.

Aster’s price is down 6.03% over the week. Without stability near local support, the remaining long positioning could face liquidation pressure. Traders now watch whether support holds or whether the setup transitions into a deeper corrective phase.