Key Insights:

- Cardano breaks below $0.52, approaching a multi-year trendline that now acts as final technical support for the bullish structure.

- Spot market outflows increase as ADA records more red days, pointing to declining holding appetite and rising exchange activity.

- Technical signals across all timeframes confirm persistent bearish pressure, with no strong buying reaction near key trend levels.

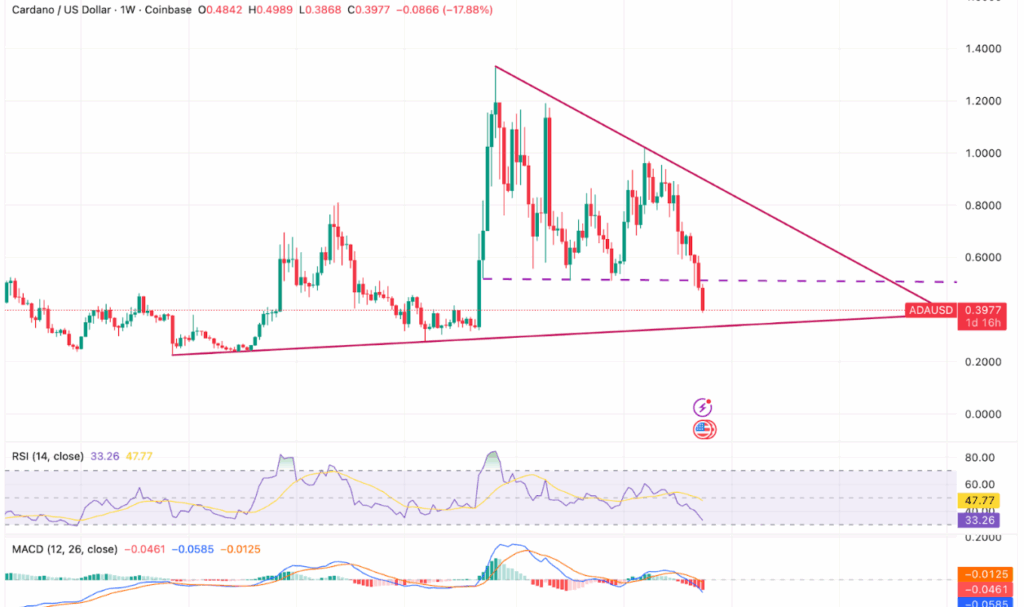

Cardano is trading near $0.398 after falling below a crucial horizontal support level that held firm around $0.52 for several months. This breakdown marks a significant structural change as the cryptocurrency tests a long-standing ascending trendline traced from the 2023 lows. The trendline has now become the final technical support holding the broader bullish structure.

On the weekly chart, the latest candle pushed through the multi-month support range and landed near the trendline. Technical indicators signal bearish momentum. The Relative Strength Index is hovering around 33, nearing oversold conditions, while the MACD shows a clear downward slope with widening signal lines, confirming sustained seller dominance.

Micro Trend Reinforces Macro Weakness

Lower timeframes show continued bearish pressure. On the 4-hour chart, ADA remains below a declining channel. The price is still trading under the 20, 50, 100, and 200 exponential moving averages. All rebounds have been contained between $0.43 and $0.46, reinforcing resistance. Until a breakout above these levels occurs, the price remains locked in a downtrend.

Technical signals continue to align with a bearish structure. The Parabolic SAR dots remain above the price, indicating sustained downward pressure. ADA’s repeated failure to reclaim the channel midline signals that sellers are still in control.

Spot Market Sentiment Weakens

CoinGlass data shows $2.5 million in net outflows from ADA over the past 24 hours. This adds to a consistent pattern of daily outflows observed since October. The trend reflects reduced holding confidence, as more tokens move to exchanges, increasing the potential for further selling pressure.

A recent network event sparked speculation about a possible chain halt. However, core contributors quickly dismissed these claims, confirming that block production remained unaffected. Developers deployed version 10.5.3 to address the issue. Despite social media activity, the price reaction stayed focused on broader risk trends and continued outflows.

Cardano now faces an important technical decision. A break below $0.38 would confirm a structural failure, potentially exposing $0.35 and $0.32 as the next targets. On the upside, reclaiming $0.46 with volume could shift momentum and restore some buyer confidence.