Key Insights:

- XRP’s price drops 5%, but strong institutional growth keeps market sentiment positive.

- The XRP Spot ETF is experiencing consistent inflows, nearing $1 billion in total contributions.

- Analyst Ali predicts a potential buy opportunity for XRP, suggesting positive momentum ahead.

XRP’s price has dropped by 5% in the last 24 hours, settling around the $2.00 mark. The decline in XRP’s value comes amid a bearish market trend that has affected several cryptocurrencies. Bitcoin’s price hovering below $90k has further exacerbated the negative momentum, pushing down prices across the crypto market. Despite these short-term setbacks, Ripple continues to experience significant institutional growth, particularly in the form of its Spot ETF.

Ripple’s XRP Spot ETF is seeing a remarkable surge, mirroring the performance of Solana’s ETF. For 14 consecutive days, the XRP ETF has recorded inflows, with no outflows during the period. This indicates an increasing interest from institutional investors. The ETF now nears the significant milestone of $1 billion in total inflows, further reinforcing the growing demand for XRP despite recent price fluctuations.

Analyst Signals Potential Buy Opportunity for XRP

In addition to the ETF’s positive performance, a crypto analyst, Ali, has noted potential buying signals for XRP. According to the TD Sequential indicator, XRP may be entering a favorable buying phase. This trend-following tool has become widely used by traders to predict market shifts. Ali’s chart analysis suggests that XRP might soon experience a reversal, with buyers potentially stepping in at current price levels.

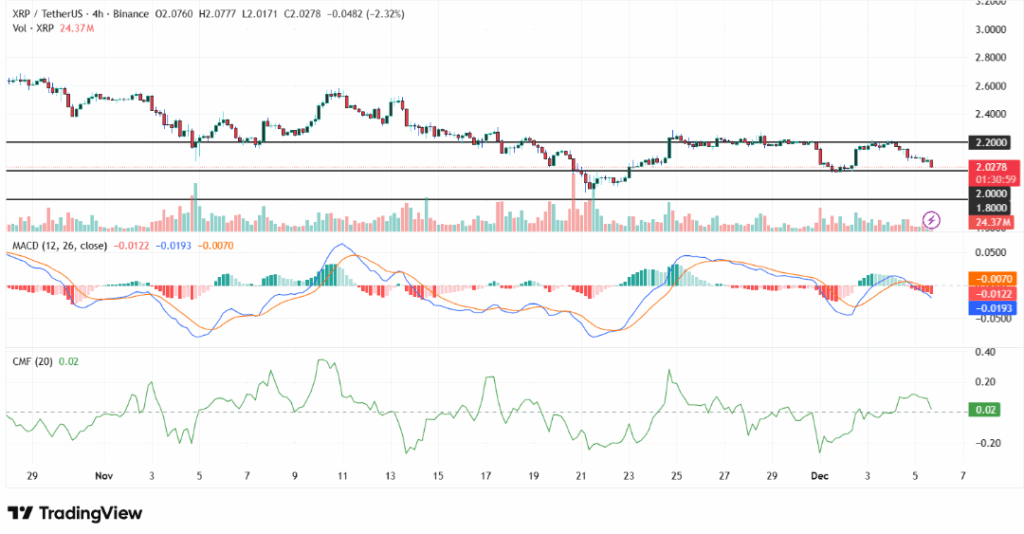

At present, XRP’s price hovers just above the $2.00 mark, with resistance seen around the $2.50 level. The coin has maintained a relatively stable range, fluctuating between well-defined support at $2.00 and resistance at $2.50. If XRP holds above the $2.00 level, it may attempt a rebound towards $2.20. However, any drop below $2.00 could signal a deeper decline, with the next key support level around $1.80.

Market Sentiment: Mixed Indicators and Bearish Trend

Currently, XRP’s technical indicators show a mixed sentiment. The MACD line is below the signal line, indicating a bearish trend. The Chaikin Money Flow (CMF), which measures buying and selling pressure, remains positive but is experiencing a slight downward trend, suggesting a weakening of buying momentum. Despite these signs of a short-term slowdown, the overall demand for XRP continues to show positive signals.